In the form of a system for payment. Russian payment systems. List of electronic payment systems

Thanks to the Internet, many new things that are greatly simplifying life have appeared in the world. Among them are various electronic payment systems that allow you to pay for services without leaving home and translate funds.

Elena Zaitseva - Financial Analyst Magazine "Khitirbobor". I will talk about the peculiarities and capabilities of electronic payment systems and analyze the most popular of them. If you want to choose or change the service for remote financial transactions, you will find a lot of useful information in the article.

1. What is electronic payment systems

An electronic payment system (EPS) is an organization that provides mutual settlements between users on the Internet. Participants in the process are individuals and engaged in commerce enterprises, banks and other financial structures.

EPS activities in Russia are regulated by the state. The main regulatory act is the law "On the National Payment System".

Electronic payment systems allow:

- pay utility services, mobile communications, television, etc.;

- acquire goods in online stores;

- output funds for bank cards and accounts;

- exchange currency;

- translate money to other participants in the system, for example, within the framework of the business.

The list is incomplete. The possibilities of virtual services are extensive, their functionality is constantly improving and expanding.

Electronic money is used for calculations - virtual digital units issued by the system.

Features of digital cash:

- Release only in electronic form.

- Provided with real money.

- Guaranteed to release them EPS (issuer).

- Stored on electronic media.

- They are recognized not only inside the system, but also when calculating with external counterparties.

Virtual money is stored on e-wallets - the name of the user's account in the selected system is so called.

2. How do they work

The principle of operation of the EPS is similar to traditional non-cash transactions. Each user has a personal account by which calculations are carried out with counterparties and between their wallets.

Simplified work scheme Next:

- the user's digital account comes with real money;

- at the inner course, the service is exchanged for virtual currency;

- the owner of the account makes the necessary transaction (translates funds to a private person, buys goods, etc.);

- the counterparty receives an electronic currency;

- the system redeems his internal money back, giving traditional in return.

After exchange real money On the issuer's digital income from the issuer arise over the user. The EPS guarantees that at the request of the participant, the virtual currency will be exchanged for real money.

To use digital cash is possible, the recipient organization must accept payment in virtual currency.

Often operations pass through intermediaries.

Example:

The owner of the wallet makes the application for the translation virtual money on a bank card. The operation takes place through an intermediary - an organization that takes digital money changes them to traditional and translates according to the specified details.

As a result, the amount in the required currency comes to the client's account, for example, rubles or dollars.

Similarly, operations are carried out in favor of companies that do not accept virtual money. Sometimes the role of the intermediary performs the EPS itself.

3. What makes electronic payment systems earn

The main income comes from commissions for conducting transactions. For example, Webmoney, one of the leaders in the digital cash market, with each user operation holds 0.8%. The tariff applies both to external translations and the actions between the accounts of one user.

Additional EPS earnings are obtained from:

- User certification.There are different wallets. To make an advanced set of actions or translate more money, you need to go through certification - provide passport data, confirm the phone number, meet with a company representative for personal identification. Often the Commission is charged for the service.

- Use terminals. Top up the wallet can be different ways, Payment Terminal or Affiliate ATM is one of them. The operation is charged the Commission. For example, Yandex.Money service depending on the selected terminal holds from 0% to 19% for one replenishment.

- Using your own cards.To simplify the input and output of money, EPS produces cards, maintenance and support of which costs money. The fee is taken for the release, cash removal, SMS informing and other operations.

The list is incomplete. In addition to listed, there are many other ways to earn money - fee for confirming transactions, commission from partner organizations, providing intermediary services, etc.

4. Benefits and disadvantages

Electronic deals are beneficial both the EPS itself and its corporate partners. The issuer of the virtual currency receives the Commission for the operation, and outlets Do not spend on collection and storage of cash.

The user from such calculations receives:

- convenience - operations are carried out from home or other space if there are internet;

- reliability - subject to the security rules for the use of the wallet, the service protects the information and the safety of funds;

- unlimited use - digital cash does not matter and does not burn;

- free accompaniment - for servicing the wallet fee is not charged;

- high payments - many operations are carried out almost instantly, delays are possible when attracting intermediaries;

- transparency - all transactions are fixed, the history of e-payments can be requested at any time.

But besides the advantages, the EPS has disadvantages:

- the need to confirm the personality - for the full use of the account, it will be necessary to provide personal data and documents;

- restrictions in use - not all companies and trade organizations take virtual money, although their list and grows;

- commissions - some mandatory fees are essential, which is especially noticeable on large amounts;

- difficulties with recovery - with a loss of password, resume work due to increased security requirements will be difficult, it will be necessary to provide many confirmation of information.

Each user will find for itself significant advantages and substantial disadvantages. For example, for me, the Commission for the withdrawal of funds with WebMoney to the card is too high. Because of this, I try to minimize the use of virtual money.

Check out the video to find out the independent opinion of the expert on the features and prospects of digital cash:

5. What are the types of EPS

There are several types of electronic payment systems. They can be divided into transaction participants, by the amount of transaction, in terms of payment, according to currency, etc.

More often than others use classification at the time of entering money into the system. According to it, credit and debit types of EPS are distinguished.

Credit

For settlements between participants of such services, credit cards are used with additional protection - message encryption and digital signature. The operation requires to confirm the creditworthiness and compliance of the valid payment data of reality.

The main feature of such transactions is that the contract is the contract, and then pay or transferring money.

Credit EPS includes First Virtual, Open Market, Cybercash, CheckFree and others.

Debit

Almost all international electronic systems Payments relate to debit. The principle of their work is that translations and payment operations are available to the user strictly after replenishing the account.

Some debit EPSs use not digital cash, but electronic checks.

The principle of their work is as follows:

- The sender of payment releases a check and assures his virtual signature.

- The document is translated by the recipient through the arbitration of the system.

- The service checks the check.

- If violations are not detected, the payment is accepted.

- Means from the account of the released user's check are transferred to the recipient.

Digital checks use a limited number of systems - Netcash, Netchex, Netcheque and some others.

6. Top 5 electronic payment systems in Russia

Not all world EPS are known or used in Russia. This is due to both difficulties with replenishment and output of funds and with restrictions in application.

WebMoney

It is considered the market leader. The company's development began in 1998. During this time, more than 36 million people joined Webmoney.

The account owner has the right to open an unlimited number of wallets in virtual analogues of various currencies, including bitcoin and gold. All accounts are combined into a kind of Keeper storage, an individual WMID number has been assigned.

All operations are instantaneous and irrevocable. Commission for any transaction is 0.8%. To work, you must provide personal data and confirm them. There are several types of certificates. The higher the account status, the more features have the user.

Yandex money

A commercial non-bank organization has a license of the Central Bank.

The user is invited to open one of the three possible wallets - anonymous, nominal or identified. Status affects the maximum possible residue on the electronic score and limits for translations.

NPO Yandex.Money has its own card for payment and cash withdrawal, tied to the wallet. Cost for 3 years - 200 rubles.

PayPal.

International EPS, unites more than 200 million users. PayPal allows you to pay for purchases on the Internet and make translations both within the country and abroad. You can open both personal and corporate account.

The main advantage of the service is the translation within a country for a private client will be free when writing off the PayPal Wallet. There is no fee for payment for the services of the Commission.

If the translation is at the expense of funds on a tied card, the Commission will be 3.4% + 10 rubles for each operation.

QIWI

It offers simplified registration - to create a wallet, it is enough to specify a mobile phone number. When opening an account, the QIWI service assigns the client the minimum status, which, after passing the certification, will be replaced with the main or professional.

Through the service you can pay for services or translate money. For ease of use, the client is proposed to release a free map associated with the means on the wallet.

PAYEER

The service offers to translate funds in more than 200 countries in the world with dozens of ways. At the time of writing Articles (March 2018) on the PAYEER website stated 157 online exchangers.

It is possible to release a free map and take funds to it without commission.

To understand what service it is more profitable to use for the withdrawal of funds to bank accounts and cards, the data on the commissions are reduced to the table:

| № | Service Name | Commission for the conclusion on the card | Commission for conclusion on account |

| 1 | WebMoney | 2.5% + 40 rubles or 2% if the service finds a counter application from another participant | Depends on the proposals of other participants, on average 2% |

| 2 | Yandex money | 3% + 45 rubles | 3% + 45 rubles |

| 3 | PayPal. | Free subject to the use of funds from the wallet | |

| 4 | QIWI | 2% + 50 rubles | 2% + 15 rubles |

| 5 | PAYEER | From 0% to 5% | From 0% to 5% |

7. Conclusion

Now, knowing the basic information about the EPS, you can easily choose a suitable need for your needs.

The main thing is to ensure the safety of the use of the service. Use complex passwords and do not report personal data to anyone. Working at the computer from which you come to your virtual account, do not attend dubious sites and do not go on suspicious links.

Question to readers:

Do you consider the possibilities of virtual money useful personally for you?

We wish you to find a convenient, functional and comfortable to use electronic payment system. If you have any questions, ask them in the comments. We will be happy to answer them!

Webmoney electronic payment system was founded in 1998. To date, more than 5 million people use this payment system. All payments can be produced in any of the currencies, including the dollar, euros, ruble or hryvnia. The list is gradually expanding. The possibility of conducting an account in the equivalent of the value of gold is also available. For account management, you need to register and download WebMoney Keeper Account Management Program. Each user after registration receives its unique personal number of the WMID, which it is identified in the system. For each currency in the program there are appropriate wallets WMZ, WME, WMR and WMU. You can create additional wallets. Properties wm are as follows:

Sufficient security of your funds from theft.

Opportunity quick access To information on accounts and even the implementation of payment transactions through the PC, PDA or Mobile Phone.

Fast payment operations - Translations are carried out instantly.

Other features of the system, which are both advantages and disadvantages:

Dependence on currency exchange rates with which WM title signs are associated.

Limiting "Mobility" in case of use of the standard WMKEEPER (but the most reliable in comparison with other means of managing means).

It briefly ... At first I wanted to recrep part of the description from Webmoney site, but then I decided that those who were already registered and working with WM, it would not be interesting. Those who first meet this system, it is better to read the original, especially since everything is there in Russian ...

QIWI payment service designed to pay for various everyday services, from mobile communications and LCD to bank loans. The feature of the QIWI service is that payment can be made both in cash in the QiWi payment terminals network and through the Internet service and the application for mobile devices. In fact, the user can make payment from his account in the system, being in a convenient place for it and at a convenient time.

Yandex money Electronic payment system, one of the popular services of Yandex, the largest Russian portal and the leading search engine in the Russian-language part of the Internet. Currency - Russian rubles

RBK Money. I want to tell another interesting payment system - (earlier - Rupay). This payment system is slightly different from the previously mentioned, it is rather a universal Internet bank, because His activity is significantly based on banking operations with plastic cards.

Single wallet - Electronic payment service that ensures financial calculations between the participants of the system in real time and intended to serve the needs of the population, primarily related to the payment of services.

Multiplatform Internet payment system W1 allows you to pay from any mobile device or computer services of cellular operators, cable and satellite television, suppliers of various services, including utility and bank loans.

Over 450 companies - service providers are partners of the "Single Wallet".

June 2, 2007 - the official birthday of the payment service "Single Wallet". On this day, the first user of the service was registered, and on June 18 of the same year, the first payment was made in favor of the cellular operator.

The owner of the service is the Company CJSC Information and Processing Center (CJSC "IPC"), providing services in the field of e-commerce, including the processing of payments on the basis of its own X-PLAT payment system.

The legal space of the Single Wallet system is the Russian Federation.

Until recently, the "single wallet" worked only in the ruble zone, but despite this, the geography of its use is rather wide. Russian citizens, more than 88 countries of the world, use the services of this electronic service.

From February 2009, after the start of W1 SA, the official currency of calculations is also South African Rand. In the near future it is planned to launch W1 USA in the dollar zone.

rest of users of the service The single wallet is provided with cash posted on the settlement accounts of CJSC "IPC". In fact, these funds are advanced user payments to future orders.

The relationship between users of the service and the company CJSC "IPC" is regulated by the current legislation of the Russian Federation and the Treaty on the use of the payment service "Single Wallet", concluded in accordance with paragraph 2 of Art. 437 of the Civil Code of the Russian Federation through agreement with the terms of the Public Offer during registration.

Z-Payment. - electronic payment systemwhich integrates various types of payment, such as SMS payment, bank transfers, payment of a plastic card and others. In 2002, a group of developers was created by the technological platform "Transactionator", on the basis of which Z-Pay and Z-Payment were subsequently created. On September 1, 2006, Zorbit (Investor) and the Transactionor (Developer) company launched the Z-Pay payment system. The system existed until April 2007, then the investor company was disadvantaged without the right to change. On September 1, 2007, the developers of the Transacitor opened the Z-Payment payment system.

Any Internet user can register his wallet in the system. Calculations in Z-Payment are conducted in conventional units of ZP, 1 ZP is 1 ruble. With the Z-Payment Wallet, you can make payment in online stores connected to Z-Payment, as well as pay for various services including cellular communication, satellite television, Internet service providers, etc. If the user has its own online store or paid service, it can connect payment through the system. The user can work both physical and legal entity.

Intellectmoney - Electronic discount payment system. Its main task is to provide users with a simple and secure way to pay for goods and services on the Internet and enable to obtain significant discounts in trade and service enterprises.

In parallel, two directions are developing: a payment that provides financial settlements in real time between users (individuals and legal entities registered in the system and activated), and discounty (within the Cash Back discount program).

All operations are performed only with Russian rubles. The web interface is used to work with the payment system.

Register in Intellectmoney can both physical and legal entity. For them there are two types of accounts: personal account and business account.

Moneymail - Electronic payment system, allowing you to pay hosting, acquire goods and services in online stores, replenish game accounts in online casinos, pay bills for utilities and telephone services, payable with Internet service providers or for cellular communication, use credit cards of Russian banks And also invoice and send money to any e-mail.

The main intended system is the development of the software package, with which Russian banks will be able to offer the entire range of technological banking products to a wide audience of Internet users.

The owner of Moneymail is the company CJSC "Maimayl", the controlling stake which belongs to the investment holding "Finam". November 24, 2004 - the official day of the launch of the Russian payment system Moneymail.

CyberPla.t.

® ("CyberPlat") is a processing company, the integrated payment system, the largest in Russia and in the CIS countries on the scale of the network of receiving payment. At the end of 2009, there are more than 400,000 points of receiving payments, of which more than 230,000 in Russia and the CIS countries, 170,000 in the largest cities of foreign countries. At these points, receiving payments can be made cash payments to more than 650 operators (providers) of various services.Cyberplat. ® (CyberPlat) is a historically first Russian payment system - March 18, 1998, the first transaction was made in favor of the Garant Park company, and on August 12, 1998 was the firstoN - LINE Payment via the Internet in favor of the cellular operator Beeline.Icqmoney -

electronic payment system, integratedin Popular Instant Messenger- Clients (Miranda, IMADERING, DELTA KEY INSTANT MESSANGER, QIPother ). Payment of services and the transfer of funds from one account to another is carried out directly through the interface of the messenger.For the first time the system was launched at the end2007. Today, ICQMoney users have the ability to replenish a mobile account, translate virtual means to others iCQ users, Pay for goods and services in online stores. Account replenishment is available from other electronic payment systems and through terminals.If there is no desire to install an additional plugin for ICQ, each user can carry out transactions in personal virtual Cabinet. Today, Icqmoney uses three currencies: Ukrainian hryvnia, Russian ruble and Moldavian lei.Raycash -

electronic payment system. Paycash is a Russian high-tech project in the field of e-commerce. The system allows you to perform instantaneous, secure and provable payments through an open data network.On the this moment Progress stepped far away. Calculations have long happened not only in cash, but also the card, as well as online through electronic payment systems. The list of these services is regularly updated.

Currently, online investments and payments that cannot do without electronic money are developed. During the origin (the beginning of the 90s) it became clear that traditional financial products are not suitable for electronic calculations. This is how the current online payment systems appeared. The list and features of each of them are presented below.

Principle of operation

There are such systems in different ways. Basically, the founders of such services create their own e-currency. They call them original, as to use "money" in the title illegally. However, it is important to understand that beautiful terms talk about the absence of any financial guarantees and deposit insurance.

All at the conscience of founders who value their reputation. In fact, participants are registered and transactions are being conducted. Each depositor has personal Area and in which the amount of money is recorded on his account.

Separate services even have their own exchange offices for cash issuing.

Advantages and disadvantages

Electronic payment systems The benefits list are considerable.

- Instant transactions (transfer of funds, payment for online shopping, conversion).

- Low Commissions (due to high competition).

- Anonymity (big plus for those who work semiably).

- Funds can be transferred to any bank accounts.

- Greater safety (than in cash calculations).

- Very convenient for receiving salary remote employees.

- Ability to pay housing housing and communal services, telephone, Internet.

Payment systems The list of disadvantages also have.

- The main disadvantage is that accounts are not fully legal.

- Not all purchases can be paid by electronic money.

- The service of the conversion of funds to cash is expensive.

- Due to the lack of control by the legislation, it is often possible to encounter fraudsters (on free hosting, such sites are created in 5 minutes, so you should check the service for authenticity).

To check the EPS to authenticity, it is enough to know whether large financial structures are collaborated with this service (Sberbank of Russia, Alfa-Bank).

List of payment systems in Russia

The main services operating on the territory of the Russian Federation:

- "Yandex. Money" is one of the most popular in Russia. With it, you can exercise many payments. In particular, payment paid games and other Internet services, utilities, telephone, shopping in online stores. It also uses money transfers.

- ARSENAL PAY - payment system of the seaside edge of the country. This is another reliable service to transfer funds and make payments. The service does not accrue hidden commissions.

- World (NSPK) is a Russian payment system, founded by the Central Bank. The system guarantees the safety and absence of interruptions in working during various financial transactions in Russia.

There are also other Russian and international payment systems, the list of which is presented below:

- WebMoney is the most popular international service. With different currencies there is a separate guarantor. Users have a unique WMID number to use the personal account.

- PayPal is another global system. Her feature: All calculations are made in real money.

- QIWI (Kiwi) is a global leader among instant payment systems.

Good day to everyone!

The Internet is increasingly embedded in our life. Now and money can be quickly transferred to relatives or friends, and some things to buy, and pay insurance, receipts - and all this, without leaving home!

All these transactions with money cannot be implemented without payment systems . Now, of course, many online shopping allow you to pay for the card, but not in all stores you can do with plastic alone. I'm not talking about translations, the same can go to 5 days, but translation, let's say, in QIWI - up to 5 minutes! Difference on face 👌 ...

In this article I want to stay on the most necessary payments that are used on the Internet (Where it can be relatively safe to keep money and dispose of them). By the way, many of them allow saving money, because Commissions for translations within their system cheaper than in many Internet banks ...

One view of 1-2 letters - and you can gain problems with blocking or freeze account before finding out. In addition, not confirmed wallets have certain limits on the use money.

Qiwi-wallet

Qiwi-wallet is one of the easiest and most convenient ways to pay for purchases and make transfers on the Internet. All that you need to start work - only the presence of a mobile phone (when registering QIWI rigidly sniffs mobile number (for security)).

The service allows you to pay utility bills, make purchases, carry out instantaneous money transfers, and all this with a very low commission (of course, relative to other services).

Also, QIWI has a fairly wide network of payment terminals, there is mobile app, Various Internet resources that everything is associated with this payment by simple and convenient.

Main advantages:

- works in many countries of the world (more than 20 at the time of writing the article);

- operations and translations are carried out practically instantly (the Commission is minimal or absent);

- there is so (This is the return of a certain percentage of purchase costs (for example, bought for 1000 rubles. Goods - 100 rubles. Returned to you on the wallet). According to some offers of online stores - Cashbek comes to 10-15%!);

- close integration with other Internet wallets, mobile account operator;

- easy replenishment of the wallet (and in many cases without commission) from Internet banks, cards, other payments;

- there is no connection to the Internet, you can send the translation even with SMS messages;

- interface friendly and allows easy step by step option to perform your task (translation, replenishment, removal, etc. Tasks);

- before completing the translation, QIWI will warn you about all commissions;

- you can order a plastic or virtual card (and pay to it as a regular bank card).

Yandex money

Very popular payment system on the Internet in our country. It is primarily its simple registration and use. In addition, it contributes to popularity and what supports the system is one of the most popular Yandex search engines.

Order Payment: Please note that Yandex gives any guarantee that your purchase will be delivered to you (otherwise you can challenge her and return your funds)

Main advantages:

WebMoney

![]()

One of the oldest, popular and multifunctional payments on the Internet (appeared in 1998, even many banks for this past time went into oblivion, and Webmoney lives and develops). It has the goals near the unique services, because Say, flagship in Internet calculations 👌.

Main advantages:

- take in most online stores (the widespread distribution);

- works in many countries of the world (widespread in the CIS);

- wallets can be in different currency: Russian rubles, Belarusian, hryvnia, dollars, and even bitcoins! Convert currency from one to another using your own stock exchange (minimum percentage);

- one of the highest levels of security (there is no longer anywhere else!): Spec. The application for PC and smartphones, a key file, a password to access the application and the key file, work with enum. Webmoney also provides certificates and BL (a kind of honest and respect) for each of the participants. This also contributes to honest and open work;

- a huge number of opportunities for replenishing and removing funds on account: bank cards, accounts, other payment systems, remittances, etc.

- instantaneous translations inside the system;

- the ability to translate money with the protection code (until the code is entered - the money will not be credited to the recipient's account. It is convenient when you want to progress yourself, and suddenly they sent it, or he has not yet fulfilled you a service);

- the possibility of organizing payments;

- ability to carry out transactions (protected!);

- easy and fast payment of communal, cable TV, Internet, mobile phone and much more (everything in one article does not describe - this is a very multifunctional payment system with constantly complementful features!).

PayPal

![]()

One of the most popular payment systems in the world, more than 200 million registered people at the time of publication of the article! The payment, of course, is not so much common in Russia (it has not come to us so long ago), but it is used abroad in the vast majority of online stores and services.

One of the main advantages of the system is the simplicity of translation, just know only an e-mail member, and you can send him money! Moreover, PayPal guarantees the safety of your funds, and gives a certain time (up to 180 days) to challenging the transaction (for example, you ordered something online, but you were deceived and the goods did not provide - Paypal will return to you!).

Main advantages:

- the widespread distribution in the world - if you want to get a transfer of money from abroad, there is nothing easier than with PayPal (just the same QIWI there is unlikely anyone knows);

- high level security;

- the possibility of challenging the transaction (refund of funds);

- there is a mobile application (and, by the way, very comfortable!);

- instant transfer of funds from the account to the account;

- protection of your bank card to the Internet - when paying it is not seen anywhere (the map is tied to your payPal account And when buying, money from the card go through this payment. Those. No online store will recognize your personal data from the card).

Rapida

Rapida- The popular Russian payment system designed mainly to pay for various services: communal, telephone communication, Internet access, loans, etc.

It should be noted that the popularity of the system is somewhat lower than the Webmoney or Yandex money (apparently due to the fact that the original system was aimed at working with large companies: utilities, banks, search engines etc.), but in lately Rapida plays part of the market ...

You can replenish the wallet in rapid using terminals, banks, plastic cards, such operators such as "Euroset", "Svyaznoy", "Technosila".

Key Features:

- payment of loans regardless of the schedule of your bank - Rapid will transfer everything urgently at any time of the day;

- wide opportunities to work: you can pay housing and public utilities, traffic police fines, Internet services, perform translations, replenish your phone account, buy a ticket or a ticket, order a prepaid card and much more in a couple of clicks with the mouse!

- minimum Commissions for Conclusion to other payment systems and plastic bank cards;

- for MegaFon subscribers and Beeline, it is possible to make a payment directly from the mobile, specifying the transaction code and the amount;

- on the service site, detailed statistics on your payment are always available (money is not stuck and not lost during translation).

W1 (single wallet)

"W1" he is a "single wallet" (or "Wallet One") is an electronic payment system designed to combine all Internet payments in a single wallet.

Walking works with many countries, including: Russia, Ukraine, Belarus, Kazakhstan, Tajikistan, etc. Differs its close integration with mobile phones (In the same Viber, you can now watch the account balance and dispose of them), and low commission transfer and replenishment commissions.

Main advantages:

- payment of mobile services, housing and communal services, cable TV, etc. Popular tasks;

- payment of loans 24h. per day;

- translations within the system in a matter of minutes!

- purchases in online stores;

- transfer of funds to other payment systems: WebMoney, Yandex Money, etc.;

- there is a possibility of messaging between users of W1 wallets;

- close integration with mobile (close integration with Viber).

[email protected].

![]()

A fairly convenient service to transfer money from the map to the card and between users registered in this payment system. To transfer money from one to another - just know only an e-mail address. Agree, convenient?!

In general, while the service is not as popular, but over time, the turnover must be gained at the expense of a large audience Mail.ru.

Main advantages:

- money on the wallet in the system is stored in Raiffeisenbank (which gives great reliability);

- unnecessary to establish any additional programs;

- the ability to quickly and with the minimum commission transfer money from the card to the card;

- your account is easily and quickly tied by your bank card, and then you can not shine it on online payments;

- many ways to replenish account: QIWI, ATMs, bank transfers, with cards, etc.

- high security wallet and translations (to transfer money to introduce a payable password). After stopping work with the service, after 15 minutes. Access to the wallet is automatically closed.

Perhaps, it is possible to allocate from minuses that the system can only work with rubles. Also a rather weak prevalence in Russia (and its complete absence abroad).

Electronic money is the monetary obligations of the organization that released them (Issuer), which are on electronic media in user management.

The main signs of electronic money:

- implementation of emissions in electronic form;

- storage on electronic media;

- guarantees of the Issuer to ensure ordinary cash;

- recognition of them as a payment product not only by the Issuer, but also a number of other organizations.

For a clear understanding of what electronic money is, it is necessary to distinguish them from the non-cash form of traditional funds (the release of the latter, they produce central banks of various countries, they also establish rules for their appeal).

No relation to electronic money has credit cards that are only a bank account management tool. All operations when using cards are made with conventional money, albeit in non-cash form.

History of the emergence of electronic money

The idea of \u200b\u200belectronic payment systems appeared in the 80s of the twentieth century. It was the basis of the invention of David Shaum, who founded the company "Digicash" in the US, the main task of which was the introduction of electronic money treatment technologies.

The idea was pretty simple. In the system, operations with electronic coins representing the issuer's commitment files with its electronic signature. The purpose of the signature was similar to the purpose of the elements of protection of paper bills.

Principles of operation of electronic monetary systems

For the successful operation of this payment instrument, the readiness of organizations selling goods and providing services is needed to take electronic money as payment. This condition was provided with the issuer's guarantees for the payment of amounts in real currency in exchange for electronic coins introduced by them.

In a simplified form, the scheme of system functioning can be represented as follows:

- The client translates the real currency to the score of the issuer, receiving a file-banknote (coin) in return for the same amount less than the Commission. This file confirms the debt obligations of the Issuer before its holder;

- Electronic coins Customer pays goods and services in organizations that are ready to accept them;

- The latter return these files to the issuer, receiving real money from him.

With such an organization of work, each of the parties occurs. The Issuer receives his commission. Trading enterprises are saved at costs associated with cash circulation (storage, collection, cashier work). Customers receive discounts caused by a decrease in costs from sellers.

Advantages of electronic money:

- Combining and divisibility. When making calculations, there is no need for delivery.

- Compactness. Storage does not require additional place and special mechanical protection devices.

- No need for recalculation and transportation. This feature is performed by the tools for making payments and storing electronic money automatically.

- Minimum issues for emissions. No need for chasing coins and printing banknotes.

- Unlimited service life due to inconsistency in wear.

The advantages are obvious, but without difficulties, as usual, does not happen.

Disadvantages:

- The appeal of electronic money is not regulated by uniform laws, which increases the likelihood of abuse and arbitrariness;

- The need to have special tools for making payments and storage;

- For a relatively low service life, reliable storage and protection of electronic money from fakes has not been developed;

- Limited application due to unpreparedness of all sellers to accept electronic payments;

- Difficult to convert one electronic payment system to another;

- The lack of state guarantees confirming the reliability of the issuer and electronic money as such.

Storage and use of electronic money

Online wallet

- this is softwareintended for storing electronic cash and operations with them within the same system.Who organizes the functioning of these systems and conducts emissions of electronic money?

Electronic money issuers

Requirements for issuers differ in different countries. In the EU, emissions are carried out by electronic money institutions - a new special class of financial institutions. In accordance with the legislation of a number of countries, including India, Mexico, Ukraine, exclusively banks have the right to engage in this activity. In Russia, both banks and non-bank financial institutions, subject to license.

Electronic payment systems in Russia

Let's consider the most popular domestic systems And we will give answers to questions, how to buy and how to cash out electronic money in each of them.

The largest operators are Yandex.Money and Webmoney, in the amount of their share exceeds 80% of the market, but there are also "PayPal", and "Moneybookers", and "QIWI" ...

"Webmoney"

"Webmoney", positioning itself by the "international settlement system", was founded in 1998. Her owner "WM TRANSFER" Ltd. She is registered in London, but technical services and the main center of certification are located in Moscow.

Operations are carried out with electronic equivalents of a row of currencies.

For each of them the guarantor are legal entitiesRegistered in various countries: Russia, Ukraine, Switzerland, UAE, Ireland and Belarus.

The WebMoney Keeper's electronic wallet is used to work, which can be downloaded from the company's website. There is also an instruction on its installation, registration and use. The program allows us to operate equivalents of US dollars (WMZ), Russian rubles (WMR), Euro (WME), Belarusian rubles (WMB) and Ukrainian hryvnia (WMU). Gold is provided, the unit of measurement of which is 1 electronic gram (WMG).

To carry out operations, registration in the system and receiving the participant's certificate, which there are 12 species.

A higher level of certificate provides great opportunities in the work.

When carrying out transactions from the payer, the Commission is held in the amount of 0.8% of the translation size. There is an opportunity to use different species Deflection. All controversial issues solves arbitration.

We give ways to establish electronic money in the wallet:

- bank, postal or telegraphic translation;

- through the Western Union system;

- buying a prepaid card;

- by making cash in exchange offices;

- through electronic terminals;

- with e-wallets of other participants in the system.

All listed methods are associated with the payment of commissions. It is advantageous to make money through the terminals and buy prepaid cards.

And how to cash out electronic money in the WebMoney system?

You can use the following ways:- transfer to a bank account from your e-wallet;

- use of the services of the exchange office;

- through the system "Western Union".

There are virtual items where automatic mode It is possible to exchange one e-currency to another at the specified course, although formally the system does not take part in this.

Since 2009, WebMoney is prohibited at the legislative level in Germany. This prohibition also concerns individuals.

"Yandex money"

The system has been operating since 2002. It provides calculations between the participants in Russian rubles. The owner of the Yandex.Money LLC in December 2012 sold 75% of Sberbank of Russia shares.

Two types of accounts are used:

- Yandex.Korsselk, which is available via a web interface;

- "The Internet. Wallet "- the score, operations with which are produced through special Program. Its development is discontinued in 2011.

Now for new users it is possible to open only "Yandex. Wallet. "

Yandex.Money users can pay for housing and communal services, pay fuel on gas stations, make purchases in online stores.

The advantage of Yandex.Money is the lack of commissions for most purchases and account replenishment. In transactions within the system, it is 0.5%, and for the output of funds - 3%. Partners "Yandex.Money", accepting payments and output funds, can establish commissions at their own discretion.

Significant disadvantages are the impossibility of conducting an entrepreneurial system and hard limits on the amount of payments.

You can replenish the Yandex.Cecek in several ways:

- converting electronic money from other systems;

- by bank transfer;

- through payment terminals;

- cash in sales;

- through the systems "Unistream" and "Contact";

- from the prepayment card (now the release of cards is discontinued, but the activation of previously acquired is possible).

Cash over the system's electronic money in this way:

- translate to the card or bank account;

- obtaining from the Yandex.Money card in an ATM;

- via translation system.

The main share of the electronic money circulation market in Russia falls on "Webmoney" and Yandex.Money, the role of other systems is much less significant. Therefore, we consider only their characteristic features.

"Paypal"

"PayPal" is the largest world electronic payment system, created in 1998 in the United States and has more than 160 million users. It allows you to receive and send translations, pay bills and purchases.

For Russian participants, the reception of payments was possible only in October 2011, and the withdrawal of funds to date is carried out only in American banks. These circumstances significantly reduce the popularity of the system among domestic users.

The planned conclusion of the "PayPal" agreement with the "Russian Post" can be corrected, but this is a question of a non-profit of perspective.

Magnetometry in the simplest version The ferrozond consists of a ferromagnetic core and two coils on it

Magnetometry in the simplest version The ferrozond consists of a ferromagnetic core and two coils on it Effective job search course search

Effective job search course search The main characteristics and parameters of the photodiode

The main characteristics and parameters of the photodiode How to edit PDF (five applications to change PDF files) How to delete individual pages from PDF

How to edit PDF (five applications to change PDF files) How to delete individual pages from PDF Why the fired program window is long unfolded?

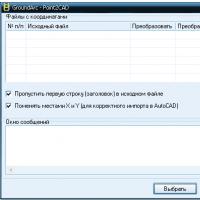

Why the fired program window is long unfolded? DXF2TXT - export and translation of the text from AutoCAD to display a dwg traffic point in TXT

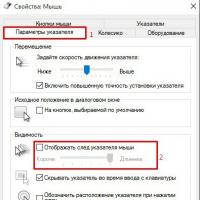

DXF2TXT - export and translation of the text from AutoCAD to display a dwg traffic point in TXT What to do if the mouse cursor disappears

What to do if the mouse cursor disappears