Belinvestbank Internet banking entrance to the Belgorod system. Personal account in Belinvestbank Internet banking. Who can use

To work with a card in the Internet banking system, the card must be activated in the system. When activating the card, you must have a mobile phone with you to receive an activation code and a card.

Connection order:

Card activation procedure

- in the "Cards" tab, click the "Activate card" button

Familiarize yourself with the contract for the provision of remote banking services for Belinvestbank OJSC (public offer), then enter the mobile phone number previously specified in the bank's branch to receive an activation code and click the "Activate card" button

Enter the personal / identification number indicated in the passport (for non-resident clients - the passport number), fill in the appropriate field with the digital activation code received at the specified mobile phone number, as well as the data of the client's personal or payroll card: full number and validity of the card, value CVC2 / CVV2 code indicated on the back of the card and click the "Activate card" button

After all procedures are completed, the activated card will be displayed in the list of cards.

To activate all cards belonging to the user in the "Cards" tab, click the "Activate cards" button, and then click the "Update the list of cards" button.

Activation of a gift card, as well as a card issued to a client's account for another individual, is carried out by clicking the "Activate additional / gift card" button

IT IS IMPORTANT TO KNOW!

If the client needs to change the mobile phone number used to activate cards in the Internet Banking system and to which session keys are sent to the client, you must:

1) in the absence of an old mobile phone number, contact the bank branch. You must have an identity document and a mobile phone with a new number with you.

2) if there is an old mobile phone number in the Internet Banking system, change the mobile phone number in the "Settings" tab.

You can change the email address for sending session keys in the Internet banking system in the "Settings" section.

3) for one client - an individual, only one username in the Internet banking system can be used, which, in turn, corresponds to only one mobile phone number.

The same mobile phone number cannot be used for more than one user in the Internet banking system.

How to restore data to the Internet banking system?

Data to the Internet banking system can be restored only if the card has already been activated in the Internet banking system.

Login, E-mail, mobile phone number

To restore the login, E-mail and mobile phone number that were specified during registration in the Internet banking system, you must contact the bank's department. You must have an identity document with you (passport of a citizen of the Republic of Belarus, passport of a foreign citizen, refugee certificate).

Password

To recover a forgotten password, on the launch page of the Internet banking system, click on the "Forgot password" link, fill in the values in the fields Username (Login), E-mail, mobile phone number, numbers from the picture and click the "Login" button. After that, a temporary password will be sent to the e-mail address specified during registration in the Internet banking system, which must be replaced after the first entry. When opening the form for changing the temporary password, in the "Enter the old password" field, you must enter the temporary password that was sent to the email address, and then enter the new password.

Online banking systems are gaining more and more popularity every day. The service "Internet banking" today can be used by clients of almost all Belarusian banks. To do this, you only need a bank card and a computer with Internet access.

Infobank.by, within the framework of the Consumer Experience project, continues to test Internet banking of various financial and credit institutions. Today we will explore the possibilities of the service provided by Belinvestbank.

To connect Internet banking in most banks, you will have to go to a branch or go to an ATM. A huge advantage of the system from Belinvestbank is the ability to connect it directly from home.

To activate the service, you need to go to the official website of the bank. In the upper right corner of the page you will see a button "Internet banking". Clicking on it will redirect you to the ibank.belinvestbank.by page, where you need to register.

The first step will be to familiarize yourself with the “Remote Banking Services Agreement” and the “Principles for Ensuring Information Security in the System”. Then you need to come up with a username and password.

Let's face it, I had to tinker with the password, the site stubbornly asked me to come up with a “different” password that would meet all security requirements. But do not forget that such "reinsurance" is aimed at protecting your personal account in the system from extraneous encroachments.

After the registration was over, we got to a page that suggested that we had not yet added our cards to the system.

How to add your card to the system? If you have it, just click the button "Activate card" if there is no card "Order a card". Note that when you issue a card through Internet banking, you get a 20% discount.

And here, for some reason, I want to once again say thank you to the specialists of Belinvestbank for saving us from unnecessary trips to the office :) Another plus is the free use of the system.

So, we registered, activated the card - now let's get started. By the way, to enter, in addition to the login and password, you will also need a session key, which comes via SMS messages.

Let's go to the main page...

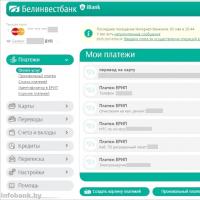

At the very top of the page, the balance of our card is displayed. There we also found a notification that we have unread messages from the bank. In these messages, the bank sends current news.

On the left side of the page is the system menu, which contains 8 sections.

In chapter "Payments" we found the following items:

- Payment for services

- Custom payment

- List of payments

- ID in ERIP

- Payment basket

In step "Payment for services" you will find a window "My payments", which displays payments saved after payment. A very handy feature that allows you to quickly find the most necessary operations.

We are changing the name to “Internet AtlantTelecom”…

Below on the page is a search by service name. For example, we want to pay for the services of the Velcom mobile operator.

Or electricity...

The search results returned 50 matches. In order not to dig into them, you can add some more criteria to narrow the search. For example, specify the locality where you need to pay for electricity. This will greatly simplify the task for the search engine.

On the same page are "List of Popular Payments"(with the help of which you can pay for the services presented in the list in a minimum number of clicks) as well as the traditional "tree" of ERIP payments.

Next item "Custom payment". Recall that in some banks this function is called "Free payment". To carry it out, you need to know the recipient's UNP, his current account and the code of the bank in which the account is opened.

Paragraph "List of Payments" contains a history of transactions made through the system "Internet banking".

In this list you will find transactions for the last month. If necessary, you can set the period of interest (lasting no more than 90 days) or view the history for a specific number of recent days. If you click on the name of any of the operations, a check will appear that can be printed or sent by e-mail.

Paragraph "Identifier in ERIP" allows you to access your personal account in the ERIP system. To do this, you must enter your payer number, after which a list of payments that you have already made in this system will appear.

Paragraph "Create a payment cart" is like an analogue of the function "One button payments" in other banks. The service allows you to simultaneously pay for several services that can be transferred to it from the section "My payments".

Thanks to this section, you can perform many different operations with cards.

For example, as you can see from the screenshots, we have 2 Belinvestbank cards at our disposal, and we can assign different names to them. This will be especially convenient for those customers who have many cards.

So we made a “Salary” card from the “Unnamed” MasterCard.

In the same section, you can choose which of the cards will be the current (settlement), allow or prohibit transactions abroad and on the Internet, and block any of the cards.

In addition, the section allows:

The message highlighted in red informs that with an increase in the share of non-cash payments, you can apply for a card of a higher category, which the bank will provide free of charge or at a discount. By clicking on this message, you can read the terms of the promotion.

The first table shows the conditions of the promotion, the second table shows the indicators on our card for the last 3 months.

For those wishing to issue another card, an item is provided "Application for a card".

You can also connect SMS alerts or use the service "Autopay"(unfortunately, it is available only for clients of the MTS mobile operator).

In this section, you can get acquainted with the exchange rates for operations with bank payment cards. The latest changes in the buying and selling rates of US dollars, euros and Russian rubles are displayed. For those who wish, there is an archive of exchange rates. Rates are shown in it for the last month, but you can set the desired period within the last year. In addition, the course archive can be downloaded in Excel and PDF formats.

The next section is "Translations". It allows you to transfer funds from card to card, from card to account and from account to card.

In chapter "Accounts and deposits" contains information about accounts and deposits, if any. You can also use the deposit calculator here. On the calculator, you choose the deposit currency, its term, the initial amount and indicate the parameters you are interested in - the calculator will calculate your income. In addition, you can view monthly income in tabular and graphical representations.

The situation is similar with the section "Credits".

Chapter "Correspondence" contains incoming messages containing bank news. In this section, you can write an outgoing message to the bank with a question, complaint or suggestion.

Let's go to the section "Settings".

Using this section, you can subscribe to the mailing list of notifications about changes in conditions, promotions. You can choose the distribution options (SMS messages or emails).

In addition, in the section "Settings" you can change the login password, the phone number to which session passwords are sent, and also the email address.

Chapter "Help" contains help information. It contains the “Remote Banking Service Agreement”, “Internet Banking System User Guide”, “SMS Notification Service Agreement” and other necessary documents. We have compiled a list of transactions (if any) that will be considered when testing the Internet Banking service:

- Mobile payment

- Internet payment

- Payment of utility bills

- Transfer from card to card

- Applying for a loan

- Opening a deposit

- Feedback from the bank

The Internet banking system of Belinvestbank allows you to pay for services in several ways:

- through the system "Settlement" (ERIP)

- using the "Popular payments" function

- using the "My payments" function

If you are just starting to use the system, immediately use the service "My payments" you will not succeed, first you need to draw them and add them. To do this, you need to carry out the operation, for example, using the "Settlement" System. And when the payment is completed, a button will appear at the bottom of the page under the check "Add to My Payments"- in the case of payments, or "Add to "My Translations"- in the case of card-to-card transfers.

But let's say we logged in for the first time, and in the list "My payments" while empty.

Mobile payment

"MTS", then - "MTS by phone number".

Enter phone number...

And the amount.

Click "Pay" and receive a check on the successful completion of the operation. The check can be saved on your computer or printed.

Internet payment

On the main page in the list of popular payments, select "Internet, cable TV", Further —"ACS AtlantTelecom - Internet".

Enter your account number...

And the amount.

This window will indicate the full name of the person in whose name the contract was concluded, as well as the amount that was charged for payment.

Then there is a receipt for the transaction.

Payment of utility bills

To pay for a communal apartment, we turn to the "Settlement" System, select "Minsk", "Communal payments", “Sq.fee, water, other rooms. services and enter your account number...

The data of the owner of the apartment and its address appear. Enter the amount to be paid.

Operation completed.

Transfer from card to card

To make a transfer from card to card, refer to the section "Cards", select the card from which we will transfer funds (if there are several cards) and press the button "Transfer to card". To make a transfer, it is enough to know the card number.

The transfer can be made in Belarusian rubles, US dollars, euros or Russian rubles. If the transfer currency differs from the account currency, funds will be debited from your card at the rates set for bank payment cards. Please note that the minimum transfer amounts, depending on the chosen currency, are 5 thousand Belarusian rubles, 1 US dollar, 1 euro and 30 Russian rubles.

Translation is carried out instantly.

Feedback from the bank

You can write a message with a question or suggestion to a bank specialist in the section "Correspondence".

Note that the answer came in just 9 minutes.

In addition, at the bottom of the main page there are two more e-mail addresses, as well as phone numbers where you can ask all your questions.

I would like to note the operational work of Belinvestbank employees. We wrote and called to all addresses and phones, and not once did we have to wait for an answer.

General impression

We really liked the Belinvestbank system. It fulfills its intended purpose - it eliminates unnecessary visits to the bank office. It can be connected while sitting at home, the card can also be ordered without leaving the apartment.

If you have any questions, you won't have to wait days for an answer to your appeal.

To enter the system, in addition to your login and password, you will also need a session password, which comes via SMS messages. This is a little annoying at first, but it's nice that you don't have to confirm each payment individually. In other words, you confirm once that you are the one who logged in, and no further action is needed.

To summarize:

Connection

- Connecting online - 2 points

- Connection is carried out immediately - 2 points

- Instant connection - 3 points

Convenience

- To enter you need a login, password and session password - 1 point

- Convenient navigation, transactions do not require many transitions - 3 points

- There is quick access to frequently used operations - 2 points

- The session password is needed to enter the system, it comes via SMS - 2 points

- Convenience of working with ERIP. There were no problems. Plus, there is a search for ERIP - 2 points

- You can change your password - 1 point

Payments

- Auto payment can only be created to pay for the services of the MTS operator - 1 point

- There is a search in the history of payments, you can set the period for which the history is shown - 2 points

- Have a function "Custom payment"- 1 point

- You can create payment templates, assign names to payments - 2 points

- Have a function "One button payment"- 1 point

Translations

- You can make transfers to cards - 1 point

- It is possible to transfer in another currency - 1 point

- The card number is enough for the transfer - 3 points

- High translation speed - 2 points

Deposits

- The deposit can be opened only by contacting the branch in person - 0 points

- The deposit can be replenished if it is provided for by the terms of the contract - 1 point

- The accrued interest or part of the deposit can be transferred to the card, if it is provided for by the terms of the agreement - 1 point

Loans

- It is not possible to leave an online application for a loan - 0 points

- Online - obtaining a loan is not possible - 0 points

- You can repay loans - 1 point

Additional features

- You can make an extract - 2 points

- You can block the card online - 2 points

- You can set limits - 2 points

- Checks are kept. You can print any of them at a convenient time - 2 points

- You can enable / disable SMS alerts - 1 point

- You can order a card online - 1 point

- You can connect the 3-D Secure service - 1 point

- There are exchange rates, there is no information about the addresses of branches, information kiosks, ATMs - 1 point

Feedback

- Two phone numbers are provided, in addition to this, you can write a message to the Contact Center in the section "Correspondence" and send an email (4 communication channels) - 4 points

- E-mail address provided (1 communication channel) - 1 point

- Minimum response time - 3 points

Personal opinion

- Overall user experience - 5 points

| Evaluation Criteria for Internet Banking | ||||

| connection | ease of connection (accessibility) 1. online, offline 2. immediately or after a while 3. connection time (min) How long can you use |

1. 2/1 2. 2/1 3. up to 20 min - 3 up to 40 min - 2 up to an hour - 1 more than an hour - 0 |

max 7 | |

| convenience | 1. authorization mechanism (login and password are enough to enter or something else is needed) 2. convenient navigation, the number of transitions to complete the operation: - pay mobile - pay utilities + electricity - pay for internet (ByFly) 3. availability of quick access to frequently used functions 4. session passwords (cards, sms) 5. convenience of working with ERIP (search) 6. convenience of changing, password recovery |

1. 2/0 2. 1 transition - 3 4. sms - 2 |

max 12 | |

| Functionality | payments | 1. the ability to create an auto payment 2. availability of payment history 3. Availability of free payment function 4. the ability to create a list of your payments, rename (templates) 5.one button payments |

1. any payment without restrictions - 2 there are restrictions - 1 no such function - 0 2. history search + time period setting + visualization - 2 3. 1/0 4. 2/0 5. 1/0 |

max 8 |

| translations | 1. to your bank card 2. to your bank card in other currencies 3. amount of data required for translation 4. translation speed (time) |

1. 1/0 2. 1/0 3. enough card number and expiration date - 3 card number + expiration date + full name - 2 account number, etc - 1 4. within hours - 2 during the day - 1 next day - 0 |

max 7 | |

| deposits | 1. the possibility of opening a deposit 2. replenishment of the existing deposit 3. possibility of transfer to the card |

1. 1/0 2. 1/0 3. 1/0 |

max 3 | |

| loans | 1. online application 2. online receipt 3. loan repayment |

1. 1/0 2. 1/0 3. 1/0 |

max 3 | |

| additional features | 1. extract 2. online card blocking 3. setting and adjusting limits 4. confirmation of payment (checks) (stored + can be printed / mailed) 5. enable / disable SMS alerts 6. online card order 7.Connection to 3-D Secure technology 8. Information (courses, branches, ATMs) |

1. for any period - 2 for a specific period - 1 no - 0 2. 2/0 3. 2/0 4. 2/0 5. 1/0 6. 1/0 7. 1/0 8. 2/0 |

max 13 | |

| Feedback | 1. connection with banko | |||

To work with a card in the Internet banking system, the card must be activated in the system. When activating the card, you must have a mobile phone with you to receive an activation code and a card.

Connection order:

Card activation procedure

- in the "Cards" tab, click the "Activate card" button

Familiarize yourself with the contract for the provision of remote banking services for Belinvestbank OJSC (public offer), then enter the mobile phone number previously specified in the bank's branch to receive an activation code and click the "Activate card" button

Enter the personal / identification number indicated in the passport (for non-resident clients - the passport number), fill in the appropriate field with the digital activation code received at the specified mobile phone number, as well as the data of the client's personal or payroll card: full number and validity of the card, value CVC2 / CVV2 code indicated on the back of the card and click the "Activate card" button

After all procedures are completed, the activated card will be displayed in the list of cards.

To activate all cards belonging to the user in the "Cards" tab, click the "Activate cards" button, and then click the "Update the list of cards" button.

Activation of a gift card, as well as a card issued to a client's account for another individual, is carried out by clicking the "Activate additional / gift card" button

IT IS IMPORTANT TO KNOW!

If the client needs to change the mobile phone number used to activate cards in the Internet Banking system and to which session keys are sent to the client, you must:

1) in the absence of an old mobile phone number, contact the bank branch. You must have an identity document and a mobile phone with a new number with you.

2) if there is an old mobile phone number in the Internet Banking system, change the mobile phone number in the "Settings" tab.

You can change the email address for sending session keys in the Internet banking system in the "Settings" section.

3) for one client - an individual, only one username in the Internet banking system can be used, which, in turn, corresponds to only one mobile phone number.

The same mobile phone number cannot be used for more than one user in the Internet banking system.

How to restore data to the Internet banking system?

Data to the Internet banking system can be restored only if the card has already been activated in the Internet banking system.

Login, E-mail, mobile phone number

To restore the login, E-mail and mobile phone number that were specified during registration in the Internet banking system, you must contact the bank's department. You must have an identity document with you (passport of a citizen of the Republic of Belarus, passport of a foreign citizen, refugee certificate).

Password

To recover a forgotten password, on the launch page of the Internet banking system, click on the "Forgot password" link, fill in the values in the fields Username (Login), E-mail, mobile phone number, numbers from the picture and click the "Login" button. After that, a temporary password will be sent to the e-mail address specified during registration in the Internet banking system, which must be replaced after the first entry. When opening the form for changing the temporary password, in the "Enter the old password" field, you must enter the temporary password that was sent to the email address, and then enter the new password.

Belinvestbank offers remote management of accounts and all financial transactions to those of its clients who are owners of the company's plastic cards. Thanks to a special Internet banking system, I made logging into it and contacting the bank convenient and comfortable: now money transfers and payments are available from home. It is enough to register on the bank's website and go to your personal account. What other features does the financial application have? What is the procedure for registration in it for legal entities and individuals? How can I enter my personal account and what is the procedure for conducting operations in it? Let's try to figure it out.

How to connect and enter the user's personal account on the JSC BIB website?

The registration procedure is simple and understandable for both individuals and legal entities.

For a private person

Includes 6 basic steps:

- signing an agreement for the provision of remote banking services;

- familiarization with safety requirements;

- familiarization with the conditions of registration in the personal account and its activation;

- selection of a user login (the name must be entered in Latin and is accompanied by the introduction of a code from the picture that appears on the page);

- indication of a valid e-mail;

- specifying a password with the obligatory repetition.

To register with ibank Belinvestbank, you may not be its client.

Internet banking registration option and “Individuals” item

Internet banking registration option and “Individuals” item

You can open an account or order a plastic card after your personal account has been created.

For legal entities

The procedure for registering enterprises in the Internet branch of Belinvestbank is completely identical to the algorithm for registering individuals and is limited to the same six steps. An authorized representative of the organization fills in the opened forms, enters a nickname and comes up with a password. Then the remote financial service can be freely used.

How to enter your personal account

Registered clients have no restrictions on the number of entries and time spent on the bank's website. To enter your own personal account of a Belarusian bank, you need to choose one of three login options.

By password and login

To use this login method, first you need to go to the bank's website at the link www.belinvestbank.by, or through a search engine, in the address bar of which you need to type "belinvestbank".

Through EDS

EDS is a digital electronic signature. It is a full-fledged means of user identification and allows you to certify electronic documents so that they acquire the force of real papers signed manually.

This method ( see screenshot above) entrance is convenient not only for individuals, but also for legal entities.

Important! Before using a virtual key, you must install a program to protect such keys on your computer.

This option is preferred by organizations, because the use of an electronic key allows unlimited transfer and acceptance of funds without a visit to the bank.

Automatic processing of payment orders signed electronically can significantly save time.

Through MSI

ISI - interbank identification system, one of the innovations in modern banking.

The essence of the ISI is that once you have registered in the information system, you can identify yourself in any bank using the Internet. This makes it possible to enter the personal account of any bank using a single entry, that is, you no longer need to remember the login and password for each of them.

Making transactions online

How to register and activate an electronic account and card using internet banking?

The personal account of the user of Belinvestbank OJSC is clear and simple: all available services are listed on the right, and when you click on one of them, a clarifying menu will open. For example, if you open the “Payment for services” item, in the refinement menu you will find all possible operations related to payments:

- Payment of utility services;

- Internet and communication services;

- cable television;

- other payments, such as taxes and fines.

Online payments make regular payments for any services comfortable and affordable. - without visiting Belinvestbank offices.

mobile version

The mobile application of Belinvestbank is under development, but the main package of banking services is already available to customers.

Mobile version of BIB

Mobile version of BIB

The service allows the holders of bank cards of JSC "Belinvestbank" to carry out many transactions via the Internet:

A client who has a card issued by this bank can get access to Belinvestbank banking, provided that a current phone number is registered in Belinvestbank. It is required to register in the Belinvestbank Internet banking system - on the ibank.belinvestbank.by website. Read the contract (public offer) and agree or disagree with it. Registration will continue if the user has accepted the offer.

You must enter a username and password. Then set personal settings: select an avatar image, enter an email address (a session key can be sent to it).

After that, you will have to enter the password twice (an indicator of its complexity is displayed).

When the registration is completed, you need to activate.

When entering your personal account, you must enter the username, password, numbers from the picture, session key. The latter usually comes in a mobile message. You can also receive the key by e-mail, but the version will be limited (without access to accounts and deposits, settings; you cannot update the list of cards and deactivate them; there is a limit on payments).

How to pay utility bills

A personal Internet bank allows you to pay for about 50 thousand different services at any time of the day, including utilities. For this, the "Settlement" system (ERIP) is used. After selecting the city (region), you must click on the link "Utility payments". A list of available payment operations will appear: rent, gas, electricity, heat supply, water utility services, housing cooperatives, housing cooperatives, etc. (lists vary depending on the region). By clicking on the desired link, the user enters the details (subscriber account number, meter readings) and make a payment. The next time you don't have to re-enter this data, almost everything will be displayed automatically.

If you need to pay for a service that is not in the initial menu, you can use the search in the Settlement (ERIP) system: enter the name of the online store or service provider in a special box.

Convenient banking services

You can quickly make payments through the main menu, which displays those that are carried out often and regularly. Just click on the link - a window will appear where all the details and payment data will be substituted, except for the meter readings.

Significantly saves time auto-payment for the services of mobile operators (as long as MTS is available). It can be configured in the "Cards" menu by clicking on the green "AutoPay" button.

To instantly receive a payment card statement, you need to select a card in the list of available ones, and then click the "Card Statement" button. It can be saved in several formats ( pdf, vsv).

SMS notification (connected through the "Maps" menu) is a paid service. It assumes that after making a payment with a bank card, a message with a brief report will be sent to the mobile phone.

SMS-banking is also available - it is connected in either an information kiosk.

Mobile version of Internet banking "Belinvestbank"

Through it, it will not be possible to register in banking, apply for a card, activate the first card. However, the basic functions regarding payments are available.

To enter personal banking from an iOS or Android device, it is best to use Safari, Chrome browsers; the functionality is somewhat limited when logging in through Opera Mini. If you fail to open the mobile version, the system will display the full version. You can also connect to it manually (via the appropriate link on the login page).

Security of work in the banking system

The basic principles are covered in the remote service agreement, which the user accepts at the time of registration.

It is allowed to enter banking from a computer or mobile device on which a reliable anti-virus program with up-to-date databases is installed.

The secure HTTPS protocol is used (SSL encryption is carried out). It is advisable to check the security certificate: 2 times click on the image of the lock in the browser. A window will appear with information about the certificate (it should be indicated that it was issued to Belinvestbank for the site ibank.belinvestbank.by).

If you notice a mistake in the text, please highlight it and press Ctrl+Enter

Typical dynamic pages

Typical dynamic pages Check Yandex TIC and Google PR

Check Yandex TIC and Google PR Limiting the speed of users who exceeded the daily limit

Limiting the speed of users who exceeded the daily limit Quick registration for Seosprint

Quick registration for Seosprint Brownie datalife engine printable version

Brownie datalife engine printable version How to make money on surfing and autosurfing?

How to make money on surfing and autosurfing? Personal account in Belinvestbank Internet banking

Personal account in Belinvestbank Internet banking