Who invented bitcoins. The Satoshi Nakamoto Riddle: Who Invented Bitcoin and Why? The history of the creation of bitcoin

No one in the world knows who is behind the name Satoshi Nakamoto, and those who do do not talk about it. Whoever knows he stopped working on a project to create and use cryptocurrency around the end of 2010. However, his activities at an early stage in the functioning of the system brought him significant profits. However, there are several theories about who this person is.

Who is Satoshi Nakamoto?

Despite the fact that we do not know who this person is, we do know exactly what he did. The fact is that it was Satoshi Nakamoto who was the creator of the Bitcoin code and, in fact, the creator of the cryptocurrency itself. In November 2008, he was first sent to the mailing list to cryptographers, revealing the essence of virtual money. Later in 2009, he created the first version of bitcoin client software. In addition, Satoshi Nakamoto himself participated in the project until he finally disappeared from the community at the end of 2010.

He worked on the project at an early stage of its development along with other people on the terms of open source, but at the same time tried not to disclose information about himself. The last time information about him appeared in the spring of 2011, when he wrote in one of his messages that "he is moving to activities in a different area."

Was he Japanese?

It's common knowledge that you shouldn't judge a book by its cover. Although, perhaps we should do it. So, if you pay attention to the name "Satoshi", then translated from Japanese it means "clear thinking", "resourceful", "wise". As for the first part of the surname "Naka", it can be interpreted as "internal environment" or "relationship". "Moto" means "origin" or "foundation". Of course, all these aspects are applicable to a person who is the creator of a cunning algorithm and one of the founders of such a complex project.

Unfortunately, we cannot know for sure whether Satoshi Nakamoto is Japanese or not. Indeed, it would be rather arrogant to assume even that the name is really "he". We just use this phrase to refer to the creator of the algorithm, although it may have been just a pseudonym, behind which could be hiding "she" or even "they".

Does anyone know who Satoshi Nakamoto really is?

It is unlikely that at present one can find people who know the one who is hiding under the name of Satoshi Nakamoto. However, many are trying to solve the mystery of this mysterious person, using incl. detective methods as intriguing as the answer itself.

For example, Joshua Davis of The New Yorker believes that Satoshi Nakamoto is none other than Michael Clare, a graduate of the cryptography department of Trinity College (Dublin). He came to this conclusion based on an analysis of 80,000 words from Nakamoto's online records. In addition, suspicions also fall on the sociologist of the Finnish economic organization, the former developer of computer games Vili Lehdonvirt. However, both "suspects" deny their involvement in cryptocurrencies.

There is a version according to which Nakamoto is not one, but three people, namely Neil King, Vladimir Oxman and Charles Bray. This is the conclusion reached by Adam Penenberg, who simply typed in a Google search box unique phrases from Nakatamo's records. Thus, he sought to determine if they were used elsewhere. And so, one of these requests was crowned with success: in a patent application filed on behalf of the three persons mentioned above, related to the updates and distribution of encryption keys, one of the phrases "surfaced".

It is noteworthy that a similar entry was posted from the Bitcoin.org domain name, which originally sounded like Satoshi. This happened exactly 3 days after the patent application was filed in Finland. All stakeholders deny this fact, including Michael Claire, who publicly announced this at the 2013 Web Summit. In any event, the bitcoin.org domain registered on August 18, 2008 used the Japanese Patent Registration Service on condition of complete anonymity. And only on May 18, 2011, registration on the site was transferred to Finland, which weakens Penenberg's theory.

Others believe that Marty Malmi, a computer software developer based in Finland, is behind Satoshi's name. He was involved with bitcoin trading from the very beginning, in particular, he developed a unique user interface for the system.

The suspects also included Jed McCaleb, a lover of Japanese culture, a resident of Japan who created the first bitcoin exchange Mt.Gox, co-founded Ripple, and in 2000 P2P eDonkey.

There is also a theory that computer scientists Donal O'Mahoney and Michael Piertz are hiding under the name Satoshi, since they are the authors of the idea of making digital payments outlined in their joint book. It should be noted that Donal O'Mahoney studied at the same Trinity College (Dublin), which Michael Claire graduated from in due time.

More recently, Israeli scientists Dorit Ron and Adi Shamir of the Weizmann Institute have established that there is a link between Satoshi and the online store selling drugs and other prohibited goods and services, SilkRoad. The relevant information was requested from the FBI in October 2013. They speculated that there was a connection between the address allegedly owned by Satoshi and SilkRoad. However, this information has not been fully verified. It was later revealed that the address belongs to security developer Dustin Trammell, who denied the Satoshi connection.

So what do we know about him?

The only information about Nakamoto that exists in wide circles is known only from the words of the people who stood with him at the origins of the development of the Bitcoin network. According to them, Satoshi thought out the whole system very carefully. At the same time, his thinking cannot be called standard. So, the main developer of the system Jeff Garzik noted that the style of writing Satoshi's code is not quite ordinary, not typical for the level of a classical software engineer.

How rich is he?

Analysis by bitcoin and crypto specialist Sergio Lerner shows that Satoshi mined most of the early blocks of the Bitcoin network. The amount of crypto coins belonging to him at that time was equivalent to at least $ 100 million.In terms of the exchange rate of the cryptocurrency in November 2013, the same amount of bitcoins corresponded to $ 1 billion.

What is he doing now?

No one knows where Satoshi is currently or what he is doing. However, in one of his last messages, dated April 23, 2011, it was said: “I have done other things. He (approx. Bitcoin) is in the safe hands of Gavin and the others. "

Did he work for the government?

There are certainly rumors of this kind. After all, some have contrived to assume that his name means "Central Intelligence". People will always see only what they want to see. This is the nature of gossip and rumor.

In this light, the question is very obvious, why should government agencies be interested in creating a cryptocurrency that will be used to finance an anonymous trading mechanism? After all, this state of affairs ties the hands of both the senators and the FBI in the fight against terrorism and criminal activity. Of course, conspiracy theorists have their own explanations in this regard.

It is possible that all these speculations are irrelevant. For example, the main developer of the system, Jeff Garzik, succinctly noted that Satoshi created an open source network for purposes that should not be available to the general public. However, the open source code itself does not allow to hide all secrets: it speaks for itself.

He also mentioned that Satoshi was too smart and therefore used a pseudonym. This made people focus on the bitcoin technology itself, rather than the person behind it. That is why bitcoins are much more famous than the founder of the digital network, Satoshi Nakamoto.

Want more news?

A bubble that will burst at one moment, leaving thousands at a broken trough, or a revolution in the world of electronic payments - the attitude towards cryptocurrencies is radically different today. Today you can hear about cryptocurrencies at every step, but not everyone fully understands what they mean and how to use them.

What is cryptocurrency - in simple words for dummies

The term stuck in everyday life after the publication in Forbes magazine in 2011, where the name "cryptocurrency" was mentioned, in English - crypto currency. In other words, it is a digital or electronic currency that is produced on the Internet and stored here on virtual wallets. There is simply no physical analogue of it.

When creating this currency, a special cryptographic cipher is used, consisting of sequential hashing and a digital signature. Hence the first part of the word - crypto.

At first glance, cryptocurrency is similar to traditional electronic payment systems. However, the differences between them are actually colossal. And the first one is the way of issuing and storing money, which we will talk about next.

But first about the pros ...

As with any concept, there are also advantages and disadvantages here. Let's start with the advantages of cryptocurrencies, and among the main ones we note:

- decentralization;

- direct exchange in the absence of intermediaries;

- transparency;

- anonymity;

- small commissions for transfers, or even none at all;

- not afraid of inflation;

- ease of use.

Decentralization

When creating a cryptocurrency, there is no centralized body that deals with emissions, that is, it issues title units, such as the Fed in the USA, the Central Bank or the National Bank in the Russian Federation or Ukraine, respectively, when it comes to ordinary money. If we take payment systems like WebMoney or Yandex.Money, they also belong to certain organizations and are controlled by them.

In the situation with cryptocurrency, there is no such central regulator. They are based on a system - in other words, a distributed database. Depending on the popularity of a particular cryptocurrency, it is stored simultaneously on thousands, or even millions of computers around the world at the same time.

A few words where does cryptocurrency come from?

A cryptocurrency is created using mathematical calculations and is a computer-generated code. In most cases, the process looks like this.

Users send transactions to each other, which are collected in blocks, sequentially linked to each other, and thus confirmed. With each block found, a certain amount of cryptocoins is issued, which is received by the one who confirmed the block.

Cryptocurrency is created using mathematical calculations and is a computer generated code. Issued in blocks linked by sequential hashing.

Such a process is called, and those who are engaged in this are called miners. Thus, this currency is issued and stored in a decentralized manner.

Anyone can build, figuratively speaking, a mint at home and turn on the printing press, subject to certain conditions. It is enough to have a powerful computer and install the appropriate program on it.

By analogy with the gold rush that hit humanity in the 19th century, today the world is swept by the cryptocurrency rush. Whole mining farms are being created that tirelessly generate more and more coins (coins).

But that's not all. With a strong desire, you can create and put into circulation your own personal cryptocurrency. If it inspires confidence among users, success is guaranteed.

By the way, it is worth noting that in certain cryptocurrencies, all tokens are issued at the start of the system, and are not mined gradually over time. These include, for example, Ripple, Cardano, Stellar and others.

And through classic mining, coins are mined from such currencies:

- Bitcoin;

- Ethereum;

- Litecoin;

- Monero;

- Dash.

Lack of intermediaries

As a rule, we exchange money (we are not talking about cash in this case) through intermediaries. These can be banks, payment systems, exchangers. They all establish their own exchange rules, which they can change at any time. In any unclear situations, your accounts may be blocked.

In the case of cryptocurrencies, there are no such intermediaries. Here, each user transfers money directly to another user's wallet from anywhere in the world.

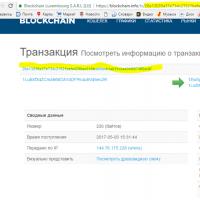

Thus, the essence of cryptocurrencies is to eliminate a third party during transactions, that is, intermediaries represented by banks, exchangers. Another nuance - such transfers are difficult to track, for example, by the tax authorities. More precisely, all transactions in electronic cash systems are visible to anyone.

It is not a problem to see how much, from which wallet and to which one the amount was transferred. The question is different - it is not easy to associate these wallets with a specific person. The main goal of this approach is to exclude fraudulent transactions and maintain anonymity.

In the absence of intermediaries, the strictly established transaction fee also disappears. Transferring money is often possible, if not for free, then for a small fee.

Another question is that it is more profitable for the miner to primarily process those transfers that provide for a larger reward. However, in comparison with the commissions of banks or exchange offices, here you can set the amount as a reward by an order of magnitude lower.

What does cryptocurrency look like?

But in fact, nothing. There are simply no physical analogues. It is impossible to physically transfer cryptocurrency from hand to hand. In fact, these are only records of transactions carried out. Let's say Vasya transferred 2 bitcoins to Gaucher - it will look like a record in the blockchain about the transaction. And Gosha will have these 2 bitcoins on his wallet balance until he transfers them to someone else.

Cryptocurrency mining algorithms

As already mentioned, all transactions in cryptocurrency systems are encrypted in a special way. For this, different algorithms are used. For Bitcoin, this is, for example, SHA-256, for Litecoin - Scrypt. Their transactions are confirmed using PoW (Proof-Of-Work, proof of work). Novacoin, in addition to PoW, also uses (PoS, proof of storage). Other cryptocurrencies like NXT only use PoS.

Other hashing algorithms worth mentioning are X11, X13, X15, N-Scrypt, CryptoNote, each with their own pros and cons.

How to get cryptocurrency

In addition to the mining mentioned above, when miners receive a commission for generating electronic currencies, you can get hold of coins either by accepting them as payment for goods or services, or for cash on specialized cryptocurrency exchanges. Among the popular ones:

- Bitfinex;

- Bithumb;

- Kraken;

- Bittrex;

- Exmo;

- Poloniex.

You can also purchase digital coins using exchange offices, which will gladly exchange dollars, euros, rubles or hryvnia for popular cryptocurrencies.

There are also so-called cryptocurrency faucets that give out tokens for free for performing certain actions - watching ads, solving captchas. However, you can get a very scanty amount of coins with their help.

How to store cryptocurrency

For this, there are special cryptocurrency wallets. They come in many different types:

- In the form of a program for installation on a computer - in this case, your coins are stored on your hard drive.

- As an application for mobile devices.

- Online wallets that can be accessed through a browser. For example blockchain.info.

- Hardware wallets in the form of physical media, similar to a regular USB flash drive.

If you buy coins on the exchange, you can keep them directly on the balance sheet of this site.

How without cons?

If there are advantages, then there are disadvantages. In the case of electronic cash, it is important to be careful about the safety of the wallet, as well as the password to it. If access is lost, you can say goodbye to money forever. It will hardly be possible to restore it.

It is also worth considering the irreversibility of transactions. If you mistakenly transferred money to the wrong wallet, you will be able to return it only with the voluntary consent of its owner.

Among the minuses, it is also worth mentioning the ambiguous attitude of different states to the existence of cryptocurrencies. Some consider them as a means of payment, for example, Japan, others either limit their circulation or completely prohibit any work with them.

What is cryptocurrency for?

Cryptocurrencies are a kind of symbol of freedom. Lack of control, transfers directly to each other - such opportunities attract many.

Therefore, given the increasing popularity of virtual money, more and more stores around the world are beginning to accept it as payment. Also, cryptocurrencies are increasingly used as an investment tool. However, given their increased volatility, this should be done carefully.

What cryptocurrencies are - how it all began and what we have

The first and currently the most expensive cryptocurrency was released in 2009 and it is called Bitcoin. It was invented by an anonymous person or a group of people hiding under the name Satoshi Nakamoto. It is with it that the very concept of cryptocurrency is most often associated.

Since that time, a great many different electronic currencies have appeared with original and not very concepts, most often sharpened for a specific industry. For example, IOTA for the Internet of Things.

Their number has already successfully exceeded one thousand. Most of them duplicate each other, differing only in names.

Developers are doing their best to outdo each other. This is how cryptocurrencies appear for the owners of Facebook accounts (Face), the LGBT community (GayCoin). Others are dedicated to famous people and contain their names in their names - EinsteinCoin, TeslaCoin.

In March 2018, the top 10 cryptocurrencies are as follows:

- Bitcoin;

- Ethereum;

- Ripple;

- Bitcoin Cash;

- Litecoin;

- Cardano;

- Stellar;

- Monero.

Most often, new cryptocurrencies are issued for specific tasks. If Bitcoin was developed exclusively for transactions and is often called virtual gold, then, for example, Ethereum is provided not only for money transfers, it already contains smart contracts. Also, on the basis of its network, decentralized applications are launched. By the way, Litecoin plays the role of an analogue of silver in the world of cryptocurrencies.

What is secured by cryptocurrency

It should be noted that digital currencies are not backed by anything: neither gold and foreign exchange reserves, nor the economy of this or that state. The only thing that determines their value is demand. The higher it is, the more expensive you have to pay for a certain currency unit. In addition, the creators of certain cryptocurrencies most often set in advance the volume of emission, upon reaching which the coins will no longer be issued. For example, Bitcoin has 21 million coins.

Capitalization, price and ratings

You can view a list of the most popular cryptocurrencies on specialized sites. An example is coinmarketcap.com. Here, in the form of a table, the top of the most common cryptocurrencies, their price, market capitalization, price chart and other indicators are shown.

Also, our site has its own, where you can find out their current value in relation to the dollar, ruble, hryvnia, view charts.

By the way, in December 2017, the total cryptocurrency capitalization exceeded the $ 500 billion mark. And in January 2018, it even exceeded 800 billion. In March, this figure has already dropped to 360 billion. Bitcoin is also in the lead with a figure of $ 150 billion.

To find out the rates of a particular currency, you should use one of the currency converters available on the network. For example, ru.cryptonator.com

Legal regulation of cryptocurrency

Different countries today have different attitudes towards cryptocurrencies. Japan officially recognized bitcoin as legal tender back in the spring of 2017 and exempted it from consumption tax on sale. More recently, in Germany, too, they began to treat it as a monetary unit of account.

Favorable attitude towards cryptocurrencies in Switzerland too. In the USA and Canada, they are treated as valuable property, and in Bulgaria - as a financial asset. The UK views digital money as a foreign currency. Iceland prohibits its citizens from buying tokens on exchanges, but mining, on the contrary, welcomes.

Is cryptocurrency banned in Russia? - Not. While officials are pondering the eternal question “to be or not to be”, here everyone conducts operations with crypto tokens at their own peril and risk.

They are going to adopt the corresponding law on cryptocurrency in Russia this year. In January, the Ministry of Finance published a preliminary text of a bill according to which mining will be classified as entrepreneurial activity, and cryptocurrencies will not be able to be legal tender.

In the so-called "gray zone" there is a cryptocurrency now in Ukraine. Back in 2017, 3 bills were submitted to the Verkhovna Rada to regulate this area, but so far none of them has been adopted.

What will happen to cryptocurrency in 2018

What will happen? - Further growth and development. This snowball can hardly be stopped by anyone. Some cryptocurrencies can sink into oblivion, others will replace them. The top 10 cryptocurrencies may change - stronger systems will squeeze those who have stopped in their development. However, digital money will no longer be able to disappear from our lives. Even if they are banned by individual states. In general, today we are talking more about the regulation of cryptocurrencies and in 2018 active steps will continue to be taken in this direction.

Who Invented Bitcoin? December 1st, 2017

Once again, the forecast of profitability in cloud mining began to move up. Who else registered on cloud mining Hashflare? Does anyone have a hash rate of 10 Th / s? I want to check if there is exactly twice the forecast of profitability? I have mined in 24 days 0,0176 the cue ball and the service charge were deducted 0.0044 cue ball from mined. As a result, net income - 10 600 rub.

I remind you. If the output button is not active (hold) is required write in support- very often unlocking occurs in manual mode (maybe they do not want to miss the moment of general withdrawal). Who has already taken something out of the mined?

After the recent jump to 11,000 and the fall, the cue ball is still climbing a little forward. And here's why there actually was this fall:

The reason for the next jump in bitcoin was a malfunction in the work of the largest American bitcoin exchange Coinbase and on the GDAX, Gemini and Bitstamp trading platforms.

From the news, it can also be noted that the American NASDAQ exchange plans to launch trading in bitcoin futures. The launch of trading will take place in 2018.

Meanwhile, a vending machine has been opened in Cyprus where you can buy bitcoins. The creators claim that it is directly related to the world's exchanges that trade cryptocurrency.

Just the other day, former SpaceX employee Sahil Gupta said that he considers Elon Musk to be the creator of bitcoin. According to him, Musk is well versed in the programming language C ++, which was used in the process of creating bitcoin.

So who is officially credited as the creator of Bitcoin?

The name Satoshi Nakamoto is known to quite a few. But no one knows who or what is behind him. But it is he who is credited with the creation and distribution of cryptocurrencies. We can also say that in 2010 he moved away from this project, having received his share of the income, and a significant one. There are almost legends about who Satoshi is.

In 2008, a person or a group of people under the pseudonym Satoshi Nakamoto published a file describing the protocol and the principle of operation of the payment system in the form of a peer-to-peer network. Development began in 2007, Satoshi said. In 2009, he finished developing the protocol and published the client code.

On January 3, 2009, the first block and the first 50 bitcoins were generated. The first bitcoin transfer transaction took place on January 12, 2009 - Satoshi Nakamoto sent Hal Finney 10 bitcoins. The first exchange of bitcoins for national money took place in September 2009 - Martti Malmi sent 5050 bitcoins to a user with the pseudonym NewLibertyStandard, for which he received $ 5.02 into his PayPal account. NewLibertyStandart proposed using the cost of electricity used for generation to estimate bitcoins.

Satoshi Nakamoto's fortune in the system is estimated at approximately 1 million bitcoins, which corresponds to 8.2 billion US dollars. The search for a mythical personality, of course, will continue further, because every 12th bitcoin is in the hands of this person or a group of people, and if Satoshi wishes, he can destabilize the currency as rapidly as he brought it to the world market.

In order to mine this amount of bitcoin, Satoshi used specific hardware: while his like-minded people, who connected to Bitcoin in the first months, launched a Bitcoin client on simple personal computers, Satoshi obviously operated several dozen PCs at the same time or an FPGA designed by him himself. computer.

And last year, Australian entrepreneur Craig Wright announced that he is the creator of the bitcoin cryptocurrency Satoshi Nakamoto. Wright presented evidence of his involvement in the creation of bitcoin to three publications - the BBC, The Economist and the London Review of Books, using the same digital signature that signed some of the earliest Bitcoin transactions in history - and it was these transactions that were usually associated with Satoshi Nakamoto himself.

Moreover, the BBC states that prominent members of the Bitcoin community and cryptocurrency development teams have confirmed that Wright is Nakamoto. In a BBC video interview, Wright said, "I was the main element, but others helped me." Additionally, Wright posted a blog post last Monday explaining in technical detail how he can prove Nakamoto is him. Gavin Andersen, scientific director of the Bitcoin Foundation, said he believed Wright's words.

sources

Alexey Russkikh

The history of the creation of bitcoin, as well as the emergence of all other cryptocurrencies, was facilitated by a number of international studies in the field of encryption and encoding of monetary transactions. In our article we will try to reconstruct the chronology of these events.

Prerequisites for the formation of BTC

So, back in 1983, David Chaum, a research fellow at the BT Faculty at one of the universities of Santa Barbara, thought about the problems of anonymity of payments, their transparency, as well as the security of monetary transactions. We can say that it was then that the idea of a new digital gold appeared.

After some research, the scientist suggested using the so-called "blind subscription" algorithm, which can be used to conduct secure transactions between anonymous users. At the same time, each such transaction and its origin will be visible to other users.

David, along with his Israeli colleagues, developed an electronic cash protocol, whereby the merchant only approves the financial transaction after the payment is verified by the other party. It was this technology that became the foundation for conducting transactions with cryptocurrency.

The cost of bitcoin after the appearance

On May 22, 2010, the first purchase with payment in bitcoins was made. For 10 thousand cryptocoins, an ordinary pizza was purchased. Then 10,000 BTC was equal to $ 25, that is, when bitcoin appeared, it was worth less than one cent ($ 0.0025).

After 3 years - in February 2013 - the value of bitcoin crossed the $ 31 line for the first time. After another 4 years, 1 BTC = $ 4500, that is, the price of bitcoin increased 145 times. Let's dream. Imagine that, inspired by the idea of cryptocurrency and blockchain technology, you understand that Bitcoin is the future. In the same 2013, you sell an apartment worth 5 million rubles, and with all the money you get, you buy 5,040 BTC at the old rate of 32 rubles / $. Your fortune today would be estimated at 1,411,290,323 rubles. That is, you could already buy not 1, but 280 apartments.

How BTC appeared

The first bitcoin appeared at the end of 2008. In October of that year, a message from a user who introduced himself as Satoshi Nakamoto came to the mail of all users of one of the popular resources at that time. The message described the essence of how bitcoin works. Users were told that this new currency in the digital environment is 100 percent fraudulent.

Significant moments in history

The history of bitcoin is full of interesting facts. Most memorable in chronological order:

- On January 3, 2009, the first block was generated (it was called the genesis block), 50 BTC was mined;

- On February 6, 2010, the first Bitcoin market was opened;

- September 14, 2010 the first mining of BTC in block 79 764;

- November 6, 2010 BTC capitalization is $ 1,000,000;

- January 2011 for the first time the capacity reached 10 Ghash / sec;

- On March 6, 2011, the bitcoin network connection speed jumped to 900 Ghash / sec, after which it dropped to 500 Ghash / sec. A supercomputer or networked superbot may have been connected to the network. Everyone remembers this incident as the invasion of the "mysterious miner";

- April 16, 2011 - First official mention of bitcoins in TIME magazine;

- June 2, 2011 - the BTC rate against the dollar was fixed at 31.91 USD for 1 bitcoin;

- March 1, 2012 - the largest theft of bitcoins (about 50,000 BTC);

- November 28, 2012 - after the generation of 210,000 blocks, the reward for miners decreased from 50 BTC to 25 BTC;

- March 28, 2013 Bitcoin capitalization is $ 1 billion.

Bitcoin crash # 1 (2011-2012)

Since its inception, bitcoins have emerged and quickly gained popularity, but this popularity was short-lived. The first problems appeared in 2011-2012. As you know, this was a period of surges in exchange rates without material support. Later, these jumps became much more noticeable: for example, in a day the currency could fall 2 times without any serious preconditions.

The problems that arose became really serious when hackers and crackers drew attention to Bitcoin. Then users began to file numerous complaints that funds were debited from electronic bitcoin wallets. One of these complaints included the loss of over 25,000 BTC.

June 19, 2012 - the date was remembered in the history of bitcoin by another major hack. An attacker managed to gain access to the MtGox service. The hacker managed to send hundreds of thousands of counterfeit bitcoins, causing the price to plummet from $ 17 to 1 cent. Thus, the attacker became the owner of about 2 thousand BTC.

Bitcoin crash # 2 (spring 2013)

At the beginning of spring 2013, the price of one bitcoin reached $ 31, and by April 10, it was already over $ 260. From the very beginning of this boom, the media started talking about the steady growth and strength of the cryptocurrency. This was until April 16, the value of bitcoin dropped from $ 260 to $ 65.

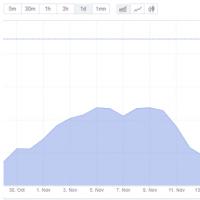

Sharp growth (November 2013)

After a sharp drop in April 2013, many thought Bitcoin could recover to $ 266 in just a few years. However, the growth of bitcoin was noted already in November. Then the digital currency exceeded the $ 300 mark and continued to grow.

Moreover, a few months before the next boom in the world media, the story of the blocking of a shadow store selling drugs flew past and made a lot of noise. It was about the Silk Road store, the owner of which was detained and the results of its activities were made public. It would seem, what does bitcoins have to do with it? The fact is that the Silk Road store worked on the Internet through the Tor browser and accepted bitcoins as payment. It was not the most successful example of the development of electronic cash, but it contributed greatly to the emergence of this currency.

Why Bitcoin is not just another pyramid

Despite the high popularity of bitcoin these days, not everyone believes that this project is not just another pyramid. Introduced just a few years ago, bitcoin, with its incredible history, is reminiscent of the dot-com boom. However, there are several reasons why this technology can be trusted:

- high degree of protection (it is impossible to forge or generate the keys of a bitcoin wallet);

- the transaction requires confirmation from other users (solution of the cryptographic "problem of two generals");

- Bitcoin mining is impossible if there is no expensive equipment;

- the volume of the market for goods and services that can be paid for with bitcoins is constantly growing;

- any changes in the protocol of the system of this currency are possible only subject to the consent of 90 percent of users.

Until relatively recently, few would even dare to suggest that a grandiose revolution is possible in the modern financial industry. People budget consisted of ordinary monetary units, with the help of which all settlement operations were carried out. Recently, however, one of the most discussed news topics both on the world wide web and in major media are such issues as the rate of cryptocurrencies, mining and, as well as other issues, one way or another related to digital coins.

Relatively recently, namely, in 2008, the first messages about cryptocurrency appeared. According to the official version, the author of such publications was the founder of bitcoin Satoshi Nakamoto. It is worth noting that today passions continue to boil around this person.

Official Bitcoin Founder

Today, almost any user, when asked who created the legendary cryptocurrency, will answer that we are talking about the Japanese Satoshi Nakamoto. However, in the history of the birth of the first digital coins and specifically as to who exactly became the founder of the bitcoin cryptocurrency and the father of the third revolution in world finance, creating new money that is not cash (cash), it remains unclear. We can say with complete confidence that this person created a crypt as a phenomenon and at the same time owns its code. Throughout the history of the existence of the MTC, three main actions can be distinguished on the part of its official author, namely:

- Transfer of documents to cryptographers with a detailed description of the essence of the cryptocurrency, signed by Satoshi Nakamoto. It was held at the end of 2008.

- Creation of a specialized program that allowed users to carry out transactions with digital coins. The first, albeit damp, but promising version of the software was born in early 2009.

- In 2010, Nakamoto stops taking an active part in the project.

It is worth noting that for all the time of his work in the community and cooperation with other specialists, this person did not often appear in public and tried once again not to advertise data about himself. The message that he decided continue activities in another industry, appeared in the community in the spring of 2011. There was also information that Nakamoto sold all the soybean coins.

The most popular versions about the personality of the founder of the MTC

Despite the fact that the official author of the first crypt has retired for a long time and now his face can be seen mainly in the photos issued by search engines, the search for the one who is the founder of bitcoin continues to this day. At the same time, the situation around the mysterious person can be called a real detective investigation. In recent years, its participants have managed to ascribe the creation of military-technical cooperation to more than one person. So for today the following contenders are among the most popular versions:

- Michael Clare, a cryptography graduate at Trinity College and ranked in the TOP 5 by the grace of Joshua Davis of The New Yorker.

- Adam Penenberg, based on an analysis of the original phrases on Google, found coincidences by which he "followed" Charles Bray, Neil King, and Vladimir Oksman.

- According to another version, the creation of the cue ball belongs to Marty Malmi, who lives in Finland. This programmer stood at the very origins of mining, and also developed a user interface for the cryptocurrency system, which allows, among other things,

- Jed McCaleb, the creator of Ripple, also made it to the list.

- And scientists Michael Piertz and Donal O'Mahoney are at the bottom of the top five.

Each of these versions at the moment checked in the most thorough way... However, no concrete results have yet been published. Apparently, the real Nakamoto managed to cover all traces.

Video: History of Bitcoin

Ripple Cryptocurrency: A Complete Investor's Guide Does Ripple Mining Exist

Ripple Cryptocurrency: A Complete Investor's Guide Does Ripple Mining Exist So do banks really need blockchain?

So do banks really need blockchain? Token what is it in simple words What does token mean

Token what is it in simple words What does token mean Remote access to a computer

Remote access to a computer Bitcoin transaction confirmation time: how long to wait?

Bitcoin transaction confirmation time: how long to wait? Versions of the reasons for the collapse of the cryptocurrency market

Versions of the reasons for the collapse of the cryptocurrency market Paid surveys, surveys for money

Paid surveys, surveys for money