What a collapse in the cryptocurrency market. Versions of the reasons for the collapse of the cryptocurrency market. Buterin's investment: good for everyone except the ETH rate

In recent months, the rate of bitcoin and other virtual coins has been growing rapidly. Today, maddened miners are buying powerful video cards to earn more cryptocurrency. It seems to them that they are investing in a promising business. Nevertheless, there are pragmatists who are confident that soon the existing system for the extraction of bitcoin and other digital currency will burst like a soap bubble. In this regard, the question arises - which of them is right?

Expert opinion

Some analysts and experts predict that in a few months there will be a significant drop in the cryptocurrency market - a rollback of their value rates or the so-called correction... In their opinion, the market bubble, so incredible in its scale, has been blowing up on this market for a long time. Since the beginning of 2017, bitcoin has grown in value by more than 10 times. At the same time, "ether" is about thirty times. As for some other crypto-currencies, they "grew heavier" by as much as thousands of percent. As practice shows, a period of rapid growth is always followed by a phase of decline. So it is possible that soon we will see how the cryptocurrency will start a steep dive. However, it will still remain a promising investment instrument in the long term.

Rapid growth

Another split of the Bitcoin network (fork) was expected in November 2017. That is why numerous investors began to speculate in order to acquire bonus coins (as was the case with bitcoin cash). In this connection, the rate of this cryptocurrency was growing rapidly. When it became clear that there would be no separation, many investors had to fix the result.

At the same time, the creators of Bitcoin Cash began to pump BCC on numerous exchanges. At the same time, they began to spread the duck through the media that the classic Bitcoin will soon give way to Bitcoin Cash. It is not surprising that there was a sell panic, the Bitcoin collapse occurred within 2 days, during which the currency “dried up” by almost 2.5 thousand US dollars.

By and large, investors were simply "thrown". It will now take Bitcoin Cash developers a long time to regain their trust.

Nevertheless, a few days later, the value of the bitcoin crypto-coin not only recovered, but also significantly increased in value by updating the next psychological maximum of 9,000 US dollars (end of November 2017), which means that until the most significant mark of 10 thousand dollars for 1BTC remained quite a bit and the achievement does not seem as incredible as before.

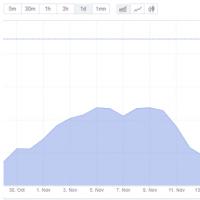

Bitcoin rate (11/27/17)

What to prepare for?

It is predicted that one of the cryptocurrencies will not replace the other, and they will be able to coexist in parallel. At the time of the drawdown, the bitcoin rate fell to almost the same mark by which the bitcoin cash rate rose. Hence, it can be concluded that they are a complementary pair.

At the same time, bitcoin cash does not provide for a clear supporting level. Market sentiment and expectations decide everything. For example, until recently, many thought that bitcoin could not be worth $ 3,000. And in 2011, everyone thought that $ 3 for 1 bitcoin was something out of the realm of fantasy. In other words, the traditional bitcoin rate, in the event that bitcoin cash becomes the main currency, may drop to $ 100.

Vadim Valeev, who heads the Crypto Invest platform, is confident that those investors who focus exclusively on bitcoin will lose their money. Those users who diversify their portfolio will be able to keep their savings or even stay in profit.

However, the overwhelming majority of investors are of the opinion that classic bitcoin will never be worth less than $ 1,000.

When will the cryptocurrency bubble burst?

The fall of cryptocurrencies today seems unthinkable, because there is an increase in the capitalization of virtual money and the development of the sphere as a whole. Most likely, in the coming years, you should not expect a sharp collapse of the bitcoin rate to a level below $ 5,000. According to forecasts, its cost will fluctuate in the range of $ 7,000 and above. But, if the excitement around bitcoin cash starts again, then traditional bitcoin may rise in price, and substantially.

The current situation does not yet portend a rapid collapse of the stock market bubble. Bitcoin Cash cannot be an alternative to traditional Bitcoin. At least until its stable capitalization takes place.

According to numerous forecasts, the classic bitcoin in a few months may reach the psychological mark of 20 thousand US dollars.

Experts draw the public's attention to the fact that one of the last falls in the traditional bitcoin rate was within an upward channel. The latter appeared in April. That is, if bitcoin drops below the $ 5.5 thousand mark, then most likely it will continue to fall in price further.

A similar situation was observed during the dot-com boom. Until a certain moment, everyone believed that everything was in order, but then it became clear that they were dealing with another bubble. Thus, if bitcoin cash proves its promise and begins to claim the role of one of the main currencies, its rate will begin to grow. At the same time, traditional bitcoin will become cheaper.

Will there be enough money?

One of the analysts at Finam Investment Company, whose name is Leonid Delitsyn, also drew a parallel between the current strengthening of bitcoin and the collapse of the dotcoms. In his opinion, a so-called positive feedback loop is being formed, which is capable of undermining the entire system. The bulk of people do not care what price to buy. They adhere to the principle - "if only there was money."

Until recently, it seemed that the Internet would quickly penetrate all spheres of life. But the process slowed down a bit. The same can happen with the integration of cryptocurrencies into the global economic system. Over time, old virtual coins may become useless, and new ones will take their place.

So what will happen to Bitcoin and other cryptocurrencies in the near future? To answer this question, one can recall the relatively recent history of numerous Internet companies that ended up in bankruptcy (the dot-com boom). Is this also possible with cryptocurrencies? Quite. And maybe everything will be different, and in 5-10 years we will forget what fiat money is.

Of course, the development of the Internet has provoked a real revolution in the field of business projects and other activities. For example, in the period from 1995 to 2004, when the World Wide Web was actively developing, labor productivity in the United States increased several times. Such trends are now imperceptible. Labor productivity is growing at an insignificant rate. So it is possible that the crypt will be overvalued - even more than the "pioneers" of the Internet in the 90s of the last century.

However, there is another opinion. Some analysts believe that, on the one hand, outside of the “shadow” market, bitcoin can be a completely useless tool, but on the other hand, it has a good prospect of becoming an excellent store of value. In short, Bitcoin can replace precious metals, over which inflation has no power.

Stanislav Werner, who is the head of the Private Solutions Singapore Castle Family Office, emphasizes that the main advantage of bitcoin is its ability to withstand financial crises. After all, it is not based on fundamental factors. Moreover, its emission is limited.

22.01.2018

17 200

Statistics show that on the crypto market, investors are less tolerant to the fall in the rate of cryptocurrencies than on the traditional one. This is partly to blame for the unreliability of cryptoassets compared to traditional instruments. In part, it is the inexperience of investors who sell coins at the slightest drop in the exchange rate, when their counterparts from the traditional market, more accustomed to fluctuations, behave more prudently. Why is cryptocurrencies falling? What to do in case of a fall in the rate of cryptocurrencies? How to make money on the fall of cryptocurrency? Let's figure it out in this article!

Why is cryptocurrencies falling?

The reasons for the fall in the rate of cryptocurrencies can be conditionally divided into technical, market, economic and political, psychological and moral and ethical.

Technical reasons:

- Loss of benefits. If there is currency A with good anonymity, but currency B appears, offering even more reliable encryption, then currency A may fall, since it will lose some of the benefits. A cryptocurrency may lose its advantage in comparison not even with another currency, but with the previous one due to modernization or other reasons.

- Forks. If, for example, a hard fork has significantly surpassed its predecessor, then it is possible that the rate of the predecessor will fall, especially if it has drawbacks that greatly complicate its use. But if the fork did not live up to expectations, then its rate will most likely decline, because investors will prefer the old one with known shortcomings to the new one with unclear shortcomings.

- Hacks and hacking attacks provoke depreciation because people do not want to lose money and quickly get rid of the vulnerable currency.

Market reasons:

- Overheating of the market. If cryptocurrencies are growing rapidly and for a long time, one can expect them to fall, because the reasons why they are growing are no longer comparable to the rapid growth, and the inertia, due to which the growth continues, gradually weakens, like any inertia.

- Dumping. Traders often deliberately collapse currencies, hoping to make money on it. This process is called and consists mainly in the sale of large quantities of cryptocurrency to create a panic.

- Domino effect. Less popular currencies often fall after more popular ones. For example, a fall in Bitcoin often provokes a fall in other currencies, although only Bitcoin can have objective reasons for the fall.

Economic and political reasons:

- State bans- whether it's a ban on trading, exchange, investing, mining, or a ban on cryptocurrencies in general. The more weight a country has in the world economy and in the political arena, the greater the collapse of the exchange rate can provoke a ban. Moreover, the collapse of the cryptocurrency rate is provoked even by assumptions about bans, when it comes to large states.

- Restrictions on the part of financial structures- exchanges, banks and others. The more influence the structure has in the financial world, the more the cryptocurrency rate falls.

- Negative opinions famous financiers and bankers about the market situation. For example, if an expert predicts a fall of a certain cryptocurrency, then it may fall because people who read this opinion will start selling it.

Psychological reasons:

- Disappointment. For example, many investors entered the market in December 2017 when Bitcoin was booming. Now it has fallen, December investors are disappointed and, since their investing experience is often limited to this month, they are selling out the purchased currencies. This situation is observed practically after each rapid growth and its gradual attenuation.

- Excessive. When the cryptocurrency begins to fluctuate strongly, many investors cannot withstand the nervous tension and leave the market.

- Vague rumors. In the absence of reasons for the fall in the rate, a vague rumor passes - and everyone starts talking about cryptocurrency, not understanding what is actually happening. Frightened by the unknown, the owners of the cryptocurrency believe that it is better to get rid of it just in case - and the rate falls.

Moral and ethical reasons:

- Ignoring developers of current vulnerabilities or other problems forces the owners to part with it, and the rate falls.

- Unethical ways to get money from users do not add popularity to the cryptocurrency, but exactly the opposite. Among them can be anything, for example, deceiving referrals (users who brought other investors during the ICO), throwing a previously hidden batch of coins onto the market, etc.

- Fraud information. The rate falls depending on the number of victims and on what actions they and other analysts took to warn others.

How to distinguish a sagging cryptocurrency from a hopeless one?

Some currencies are falling with no hope of recovery, while others are recovering successfully.

It is difficult to accurately predict the course of events, but there is criteria that can guide an investor:

- Real value... Cryptocurrencies have won their popularity for a reason. Coins in demand will sooner or later return to their previous positions. Cryptocurrencies that have no real value will be able to grow if they start to “cheat” again, which is unlikely.

- The presence of competitors... All other things being equal, after a fall in the rate, most likely the best currency in its area will begin to grow, while the worst one may continue to fall due to the fact that its niche will be occupied by the best one.

- Perspectives... If the fall of a currency is caused by reasons that can be influenced by its creators, then their actions usually determine its further fate. For example, if a blockchain is hacked, the rate falls. But if the developers quickly react to hacking, reliably protect the currency, explain the methods of protection, then the currency has every chance to grow again. Lack of attention to what is happening or lingering promises are likely to lead to further fall in the currency.

- Buying up on the market... If the currency has fallen, but offers to buy suddenly appear, then one can hope that traders will raise it. Purchase offers are generally a good sign. They say either that the fall in the exchange rate is the work of speculators, or that professional players believe in the currency and try to buy it while it is cheap, with the expectation of further appreciation.

- Reviews and analytics... If everyone says that the currency is a scam (fraudulent), then most likely it is a scam. And if its rate fell because of this, you should not hope for growth. However, if they are not talking too actively, and the currency fluctuates among the top ones, it may rise a couple of times before falling. But sooner or later, the fall will surely be final.

- Popularity... Top currencies tend to fall uncertainly. Unpopulars tend to fall faster and rarely recover. The top ones are distributed among a large number of owners, not all of whom believe in negative news, have heard about it and are ready to part with a promising asset. The unpopular currency has physically fewer holders, and they get rid of it with less regret.

It also doesn't hurt to look at charts : if the currency had a tendency to fall and rise strongly in the past, then there is a possibility that this will happen again in the future.

What to do in case of a fall in the rate of cryptocurrencies: wait

The main question for investors- wait or sell. The answer differs in each individual case.

The owner of the cryptocurrency must remember that when selling cryptocurrency, he further lowers its rate... The less popular a currency is and the less its capitalization, the stronger each sale will affect the rate. When it comes to unpopular currencies, it can be changed by the actions of even one holder.

A wait-and-see strategy is relevant in the following cases:

- if it is a promising cryptocurrency with real value, if it is supported by developers;

- if it is a giant currency that has fallen due to another local ban or destabilization in the traditional market;

- if it is a promising currency that has fallen due to the fall of giant currencies and general destabilization in the crypto market;

- if the value of the currency is clear, and the reasons for the fall in the rate are unclear, not obvious, provoked by rumors and someone's opinion.

In these cases, the probability of course recovery is high.

It is useful here to learn how to determine how valuable an asset is as a market instrument or technically, and if it is valuable - wait out such storms... And if there is no obvious value, you should be more careful about the idea of preserving it when the exchange rate falls.

However, if a not very valuable asset falls due to the market fall, then it will surely rise after it. If it falls by itself, you should pay more attention to the reasons for the fall.

The advantage of the wait-and-see position is that, due to the volatility of cryptocurrencies, it turns out to be winning much more often than a losing one, especially in the case of giant currencies.

But there is also a minus: the owner may incorrectly assess his asset, not pay attention to the factor that will provoke further depreciation etc. The longer the investor waits, the more losses he will incur.

What to do in case of a fall in the rate of cryptocurrencies: sell

Selling a falling currency makes sense in two cases:

- if the cryptocurrency falls without hope of growth;

- if its price is even higher than the purchase price of the investor, but it is likely that if it falls, it will break through this mark.

In the first case, you need to assess whether there really are no growth prospects. If not - sell as quickly as possible.

A plus: investments may be able to recoup at least partially.

Minus: the investor may incorrectly assess the situation and the currency will go back up after falling.

In the second case, it is appropriate to sell a currency if it can clearly fall below the purchase price, or if the investor prefers lower risk and lower reward to the possibility of high rewards associated with the same risks.

If the currency falls completely, investor will win... If the currency, having fallen below the purchase price, suddenly detects an upward trend, the investor will be able to buy it again without loss for himself. Unfortunately, if the rate does not reach the purchase price, it goes up again and "breaks through" the price for which the currency was sold during the fall, it will turn out that the investor has miscalculated.

The advantage of this option is that the investor will win in any case: one way or another he bought cheaper and sold more expensive.

The downside is that the investor can lose a good speculative instrument and source of income.

What to do in case of a fall in the rate of cryptocurrencies: earn

In addition to selling or taking a wait and see position, the currency holder has another option - make money on the fall... The tactics depend on the currency and the reasons for its fall.

If it is a giant currency that is falling due to economic and political events and news, the investor can start actively selling it in order to support the depreciation... After a collapse at the minimum price, he will buy it again, the currency will inevitably increase, and the investor will earn.

If it is a medium to unpopular currency, an investor with large assets can practically guide the fall of the exchange rate... But caution will also have to be observed, because an excessive collapse of the exchange rate can pull the currency further down against the wishes of the player.

The investor sells all his assets at the time of the fall in the rate, watches how the rate flies down, and at the moment when it seems to him that this is enough, buys currency for next to nothing until the rate as a result of his actions begins to rise.

Such manipulations can generate huge profits, calculated in hundreds of percent.

In conclusion, it is worth noting that the fall in cryptocurrencies usually indicates not the problems of the crypto market, but, oddly enough, its formation. Sometimes the market suffers due to lack of currencies ( in case of hacks and other "crypto" -problems), but they are eliminated by implementing hard forks and new technical solutions.

And of course, the fall in cryptocurrencies is not a negative event for an investor, who can react in time and not only not suffer losses, but also make good money.

Where cryptocurrency rates are published in real time, over the past 24 hours the cost of bitcoin (BTC) fell by 15.05%, ethereum (ETH) - by 16.07%, and the rate of another cryptocurrency from the top three, ripple (XRP), decreased by 23.04%. What does this news mean? In a conversation with a reporter, blockchain consultant website Denis Smirnov attributed the current collapse to negative news from China. There, the government closes access to all major cryptocurrency exchanges. According to Bloomberg news agency, the Chinese authorities also plan to block internal access to local and foreign platforms through which digital money can be purchased.

What's happening?

According to Denis Smirnov, it was this message that led to the decline in the market. However, the expert does not recommend giving in to panic.

“The cryptocurrency market is monstrously volatile (that is, prices change at a fast rate. - Ed.). The previous exchange rates will recover, and additional growth can be expected, ”the market analyst believes.

So, according to CoinMarketCap data, the bitcoin rate on January 17 was $ 10.2 thousand, while on January 15 this figure was at $ 13.7 thousand, and on January 11 - $ 13.6 thousand, and on January 9 the rate of this digital currency reached $ 15.4 thousand.

TASS / AP Photo / Kiichiro Sato

Bitcoin Futures Trading on the Chicago Stock Exchange

As Denis Smirnov explains, the decline in the rate of ripple, ethereum and other alternative cryptocurrencies is due to the fact that all currencies on the exchange are traded to bitcoin and directly depend on its value. Plus, the fall in bitcoin causes panic among investors, and they begin to sell their assets sharply. Another factor that led to the recession was caused by the limited admission of new participants to the exchanges, the managing partner of the First Cryptoconsulting agency added in an interview with the reporter. Pavel Burtsev... So, a few days ago, news appeared in the media that the largest cryptocurrency exchange Bitfinex (access to which, by the way, from the territory of the Russian Federation is prohibited) introduced serious restrictions on opening new accounts. They concern small investors. At the same time, the collapse in the electronic money market was caused, among other things, by similar behavior of exchanges. They cannot cope with the large flow of clients, therefore, little new money is coming into this sector, says Pavel Burtsev.

What to do?

This can be done on the already mentioned CoinMarketCap website or on its Russian-language analogue - "Cryptonovsti", as well as on other portals where courses and analytics are published in real time.

Speaking about the amounts, Denis Smirnov recommended investing exactly as much as it is not scary to lose. This will save you from unnecessary worries and allow you to calmly monitor the situation. When asked whether it is worth "transferring" funds from cryptocurrencies to other assets, for example, in dollars or euros, the blockchain consultant noted that this is not necessary yet.

“It's better to wait now. The cryptocurrency market can show good results in the long term, ”the specialist advises.

TASS / AP Photo / Ahn Young-joon

TASS / AP Photo / Ahn Young-joon

According to him, much will depend on the legislation, which in our country does not yet regulate this type of investment.

Recall that the Ministry of Finance can submit the corresponding law to the State Duma in February. In particular, the document defines such concepts as "cryptocurrency", "mining" (that is, "mining" of digital finance using computing devices) and "ICO" (initial placement of new tokens - cryptocurrency units). According to the Deputy Minister of Finance Alexey Moiseev, who was quoted by the media, is currently finalizing the law in the department. In this case, the main focus will be on ICO. Issues related to the turnover of cryptocurrency will be regulated separately, the Deputy Minister of Finance said at the time.

What will happen?

The interviewed experts believe that Bitcoin will continue its growth in the near future. It may not be as fast as before, but it will definitely happen, experts are sure. So, in a conversation with a correspondent, the website is the President of the Russian Association of Cryptocurrencies and Blockchain (RAKIB) Yuri Pripachkin believes that below $ 8 thousand bitcoin will not collapse and it will definitely be above the $ 10 thousand mark. According to the head of RACIB, price fluctuations will "wash out" small players from the market and leave only those who believe in the long-term prospects of cryptocurrency.

One way or another, a lot will depend on the legislation and the news background. Both of these factors are still strongly affecting the exchange rate of bitcoin and other digital currencies.

Ivan Shlygin 02.02.2018 10:13

23868

The panic among cryptocurrency holders is growing, many are trying to get rid of these assets. The three most capitalized projects have significantly lost in value.

Bitcoin as of 9.30 Moscow time, according to Coinmarketcap, falls by 15.2% and is traded at $ 8.6 thousand.

Ethereum is sold even more actively - the quotation is in the red by 20.6%, now you can buy a little less than $ 913.

Ripple depreciated 30% to $ 0.8. In the top 10, only Cardano is doing worse, with a 36.4% drawdown.

Yesterday, the total cryptocurrency capitalization was $ 517.7 billion, now we see only $ 409 billion, that is, more than $ 100 billion was withdrawn from this market. Bitcoin capitalization fell to $ 145.6 billion - losses per day more than $ 26 billion.Ethereum left more than $ 23 billion, and Ripple - $ 13.4 billion.

Experts argue that the market is undergoing a large-scale correction since December, when many cryptocurrencies, including Bitcoin and Ethereum, have risen in price to the highest in history.

This is happening against the backdrop of a stream of negative news. We are talking about an investigation into suspicions of manipulation of Bitfinex and Tether, as well as the freezing of assets worth $ 600 million of AriseBank, Facebook's decision to refuse advertising related to cryptocurrencies. This also includes tough measures to protect the rights of investors in South Korea and other countries.

Many are waiting for scammers and other builders of Ponzi pyramids to leave the cryptocurrency market.

Next week, February 6, in the US Congress, regulators will discuss the situation on the cryptocurrency market - we will wait for what they say.

What's behind the latest cryptocurrency market crash?

Since Tuesday, January 16, the bitcoin price has gone down sharply, dropping below $ 10,000 on Wednesday. Thus, since December, when the first cryptocurrency peaked at $ 20,000, the overall decline has been more than 50%. Simultaneously with Bitcoin, the entire cryptocurrency market as a whole experienced a serious collapse: if at the beginning of January the total capitalization of all assets in the Coinmarketcap list exceeded $ 800 billion, on Wednesday this figure at some point fell to $ 460 billion.

There is no shortage of theories about what is behind these events in various media and social networks, but one of the most popular versions was the tightening of market regulation rules around the world, including in such key countries for cryptocurrencies as South Korea and China.

Recall that in the past few days, messages about a possible ban on cryptocurrency trading in South Korea have been actively circulating, and although in the end, the presidential administration of the country announced that such, the rules of the exchanges and the general conditions of the market are already.

Meanwhile, the authorities' pressure on the cryptocurrency industry in China continues unabated: the latest news from the Middle Kingdom, which, as many analysts suggest, also partially, was the intention to block access to local and foreign platforms for centralized trading, as well as to “online platforms and mobile applications. offering services similar to exchanges. "

The influence of South Korea and China on the cryptocurrency market is really great: these two countries account for quite significant trading volumes, but in recent days they have definitely begun to decline.

This trend has been noted by many experts, including eToro analyst Maty Greenspan. He also drew attention to the decline in volumes in Japan.

“As we noted, recently there has been a downward trend in volumes in South Korea and Japan. We may have seen a slight rise the day before, but this is still very far from what we saw in November and December, ”Greenspan wrote in a letter to investors on Wednesday.

He backed up his words with charts from Cryptocompare, showing the decline in cryptocurrency trading volumes in these two countries:

At the same time, the eToro analyst explains the growth in volumes noted on Tuesday by the fact that the prices for cryptocurrencies in these two countries, which were traditionally at a higher level, have recently, if not equalized, then at least have become more in line with the rest of the world.

In addition to South Korea and China, one should probably note the repressive measures against bitcoin and the increasingly frequent politicians and officials of various levels around the world about the need for stricter regulation of cryptocurrencies. Also, the latest news from Russia and Ukraine is unlikely to add positive, although their influence on the formation of the bitcoin price is not so great on a global scale.

However, are regulatory restrictions to blame for the collapse? Not everyone agrees with this theory.

Just a correction?

"The bloodbath in the cryptocurrency market is no longer provoked by South Korea, rather, it is the exponential growth of cryptocurrencies and a correction in order to stabilize the market."

Dogecoin creator Jackson Palmer, meanwhile, says that while there doesn't have to be a reason for such a collapse, the events of the past few days seem to him a little different than before, since even trading bots could not prevent them.

While there doesn’t * need * to be a reason driving the current #crypto market crash, this dip feels different because even the market manipulating bots couldn’t turn it around.

I anticipate we’ll hear something in the coming weeks that (at least partially) explains this.

“Hopefully in the next few weeks we will hear something that at least partially explains this,” - added Palmer.

Futures

In addition to the reasons listed above, which in theory could have influenced the market crash, there is another theory. According to her, Bitcoin futures, which have been traded on two major North American exchanges CBOE and CME since December last year, may be to blame.

The first contracts - January on the CBOE - just expired on Wednesday, January 17, and the settlement rate for them was determined by the auction price on the Gemini exchange at the end of the session. And as some experts suggest, the aggressive sell-off of the last two days is precisely related to the desire to lower the price of bitcoin so that the closing contracts will be winning.

This idea, in particular, sounded on CNBC, while it is noted that as early as Tuesday afternoon, CBOE futures were trading at $ 10,000, which in theory could give investors an incentive to force the price of bitcoin to go even lower.

Have you passed the bottom?

As of 22:00 UTC on Wednesday, January 17, the weighted average bitcoin rate rose to $ 11,450, and the rest of the cryptocurrencies went up with it. As you can see in the chart below, after a prolonged “red” period, the market begins to return to the green zone.

It is not easy to say how events will develop in the short term. You can probably expect further market growth, but you should also be prepared for its high volatility and unpredictability.

Subscribe to ForkLog news on Telegram: ForkLog Live - the entire news feed, ForkLog - the most important news and polls.

Found a mistake in the text? Select it and press CTRL + ENTER

Ripple Cryptocurrency: A Complete Investor's Guide Does Ripple Mining Exist

Ripple Cryptocurrency: A Complete Investor's Guide Does Ripple Mining Exist So do banks really need blockchain?

So do banks really need blockchain? Token what is it in simple words What does token mean

Token what is it in simple words What does token mean Remote access to a computer

Remote access to a computer Bitcoin transaction confirmation time: how long to wait?

Bitcoin transaction confirmation time: how long to wait? Versions of the reasons for the collapse of the cryptocurrency market

Versions of the reasons for the collapse of the cryptocurrency market Paid surveys, surveys for money

Paid surveys, surveys for money