Should you invest in Ripple? Ripple Cryptocurrency: A Complete Investor's Guide Does Ripple Mining Exist

Investing in cryptocurrency is a profitable way to make money, because in most cases people manage to get income. However, in order to gain maximum profit, it is necessary to understand how the cryptocurrency market works. Experienced users decide to invest their money in RIPPL, because there is a good chance of earning extra money. There are certain features of the Ripple cryptocurrency that you should know about before making your first deposit.

Why is it profitable to invest in Ripple

The creators of the Ripple system argue that their main goal is to give people complete control over their finances. Also, this resource allows you to make payments between different states extremely quickly and with minimal costs. The platform will be useful even for large banks, because it allows you to save at least $ 3.5 on each transaction.

You can also highlight the following advantages of the Ripple system:

- Security of payments. As the checks have shown, the resource is sufficiently reliably protected from hacker attacks.

- You can work with different currencies.

- Extremely small commission.

- A person can completely control their funds.

At the same time, at the moment, currency can be bought inexpensively, and after a while it will be possible to make good money on it. But, of course, people should not expect that they will be able to make a profit in the near future. Although the prospect is good, however, it will take longer to gain a good income.

How to invest in Ripple

People are now often looking for options where they can invest money to multiply them. Cryptocurrencies are a good investment because there is little risk of losing funds. Of course, their rate can also fall, but in most cases it rises over time. The user only needs to know when to invest and what currency to buy.

Note that in order to invest in Ripple, you should acquire at least minimal knowledge about cryptocurrency and how to make money on it. The main way to generate income is to buy XRP at a low cost and sell it at a high rate. Therefore, it is better to invest money in cryptocurrency after a person has studied at least a little the principle of the operation of cryptocurrency exchanges.

Important! As for buying Ripple, you can do this using exchanges. For example, you can use Bitflip, Kraken, Bitstamp.

To make a purchase, you need to register on the selected exchange, and then top up your account. If a person is going to use rubles, then they should first be exchanged for dollars, bitcoin or euros. And after that, buy XRP.

Note that without a preliminary exchange of funds, you can purchase Ripple on the Bitflip exchange. However, you should not use this site for large amounts, because it has not yet proven its safety and reliability. It will be more difficult to purchase the required cryptocurrency through exchange offices, because there are few such offers left.

To invest, you need to create your own wallet, which can be mobile, desktop or hardware. Note that to activate it, you will need to have at least 20 XRP on your account. Because this number of coins is necessary in order to book a wallet address.

You can use the Rippex wallet, which is suitable for computers and laptops. It's safe, fast and easy to use. It is enough to download the appropriate version to your electronic device and create a new account. After registering, you can use the wallet to receive XRP.

For a mobile phone, you can download Toast Wallet. Again, you'll need to download the app and register. Already inside the system, you can work with coins using your Ripple address.

How to make money on cryptocurrency

It is important not only to invest in the Ripple cryptocurrency, but also to get income from it. Now there are two main ways that you can use your money wisely. The easiest way is to invest inRipplewith the aim of investing in the growth of the value of the cryptocurrency. In this situation, you will need to buy coins on a special exchange, and then after a while sell them at a higher price. The danger of this option lies in the fact that the rate may, on the contrary, go down.

You can also carry out short-term speculation on price changes in Ripple. Trading on the price chart is assumed, for this you can use a broker, or do without it. Note that experts currently assess Ripple as a worthwhile and promising resource. That is why the system is used even by representatives of the banking sector, because they are aware of its benefits.

Cost forecast

Before deciding to invest money, you should inquire about the forecast for Ripple for 2019. It can be noted that the prospects are quite good, and further active price growth will be observed. At the moment, the currency has a price of 0.9394 to the dollar, and it is tempting to purchase.

Experts note that at the moment the value of the currency is growing rapidly. The average turnover of trades in 24 hours is over $ 1,500,000,000. At the same time, the market capitalization is 35,968,413,706,99. The forecast is favorable, and in 2019 the currency may cost 60,000 and 100,000 rubles. Therefore, people who now purchase XRP can expect to make large profits with a long-term investment.

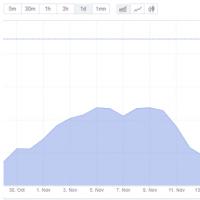

Compared to 2017, the currency has risen significantly from the 0.1964 level. Moreover, its peak was in January 2019, when the price was $ 3.40. At the moment, the rate has dropped slightly, but soon it will go up again. Therefore, now is the most favorable time to buy Ripple. People who make investments will only have to wait until it will be possible to sell cryptocurrency profitably again. And the moment will come very soon, and it is long-term investments that will bring the most income.

There is a huge amount of digital money nowadays: some of them are unique in their own way and offer the user know-how, others, like twin brothers, resemble each other. In this variety, an unusual coin called Ripple has crept in, which, in fact, is not a cryptocurrency in the traditional sense. Why is it considered so and is it worth investing money in it - the answers to all the questions in this article.

Features of the Ripple cryptocurrency

The first and to this day the main cryptocurrency is bitcoin and, whatever one may say, all subsequent coins are similar to it. And even if they are super-mega-unique, even the fact that they work for it confirms that at least something altcoins borrowed from their older brother. But the same cannot be said about the Ripple cryptocurrency - it has no connections with the blockchain and operates on its own protocol. This very protocol is based on a distributed ledger, is open source and works armed with the principle of consensus, that is, an agreement.

Immediately, we note that the developers of the ripple did not even think about any cryptocurrencies there - work on the project began in 2004, when they had not heard of cryptocurrencies and rumor. Initially, the creators had a different goal - to create a system of global and free payments. This idea was quite successful and, as a result, the internal settlement coin Ripple was born, which was successfully ranked among the ranks of cryptocurrencies. And it is not just in these ranks, but is conveniently located at the very top of the cryptocurrency TOP - its capitalization is 7.7$billion. Today, Ripple is the fourth among all respected cryptocurrencies, but there have been times when it was briefly selected for second place after Bitcoin.

But Ripple has a very specific relationship. A lot of experts say that if the role of the reserve world currency shines on cryptography, it is more likely that the ripple will be awarded this honor, and not the cue ball. And no matter how much we love bitcoin, we must admit that in terms of technical parameters it is inferior to many cryptocurrencies. Ripple, as a system of global settlements, has found active use in the banking sector, and a huge list of financial institutions around the world has adopted its protocol. Ripple may very soon change the face of the banking sector, because today it already creates real competition for systems such as SWIFT and Western Union. And yes, they are already nervously smoking on the sidelines, watching bank after bank Ripple squeeze out their market.

Does Ripple mining exist?

If you think that now with a slight movement of your hand you will download the program and start mining Ripple into your wallet, then we advise you to cool down your ardor. As mentioned above, the coin and the entire system have a fundamental difference from other cryptocurrencies and the ripple simply does not. The mining of coins is not included in his concept, because the system does well without miners - it does not need them.

Since the start of the project, which took place in 2014, 100 billion XRP coins have been “minted” and their further production is not provided for by the system. It is noteworthy that of these hundreds of billions of ripples, only 20 are distributed among users, the rest are completely controlled by the developers. This causes a lot of controversy about the fact that the project is not decentralized and the creators of the cryptocurrency can easily influence its course. To calm down the raging masses, Ripple Labs has personally blocked access to coins by smart contracts and from time to time may receive small portions of the amount for the development of the project.

Since there are no miners in the system, trusted nodes play the role of confirming authorities. There are many of them on the network, but again, only the user who has passed the Ripple Labs certification becomes a node. So there are still problems with decentralization and they confuse many users.

Where can you buy Ripple?

In terms of capitalization, Ripple sits in an honorable fourth place, which means that it is present on almost all cryptocurrency exchanges. The coin is popular, and any demand generates supply and marketplaces willingly include it in their listings. Therefore, if you are thinking of acquiring Ripple, then you will not have any difficulties in this process. Ripple is supported by many popular exchanges, including:

- Poloniex;

- Kraken;

- Bittrex;

- Bitfinex;

- Bithumb, etc.

At the same time, there are a large number of cryptocurrency exchanges created in honor of the Ripple coin, and it occupies a key place in such platforms. If you do not want to deal with cryptocurrency exchanges, then there is an alternative that is familiar to us - you can also purchase ripples through exchangers.

Ripple (XRP) cryptocurrency rate

Ripple started trading on the exchange at a cost of 0.005$, and reached its maximum in May 2017 - 0.36$... Today the rate fell slightly and is quoted at around 0.2$, but even with such a rise in price, investors who invested money in this cryptocurrency from the start were able to make very good money. In any case, in the long run, one should expect a rise in the price of Ripple, and not only because large investors and banks are paying attention to the coin and the system as a whole. In the very concept of cryptocurrency, there is a strict number of coins that are not produced, and this will withstand inflation. And along with this, the developers have implemented the process of burning 0.00001 XRP for each transaction. This is done to prevent spam transactions, and in practice, not only will it prevent an attack, but will also help reduce the number of coins. Even with stable demand, as the number of XRP decreases, the price of coins will continue to rise.

Where to store Ripple?

If you are one of those who still keep any coins on the exchange, then this is very dangerous. Crypto exchanges are very actively scammed, and the recent case with a large exchange proved this. Therefore, it is better to trust wallets for storage, but in the case of Ripple, everything is not so simple - there is no official client for the coin, the developers do not position it as a monetary unit outside their system, but suggest using the Gatehub platform for this. However, there are also alternatives.

Ripple cryptocurrency wallets

A wide variety of wallets can be used to store XRP cryptocurrency. The popularity of the coin contributed to the fact that many developers of multicurrency wallets paid attention to it and added it to their clients. But there are also specific wallets that are designed specifically for Ripple.

- RIPPEX- if you are a fan of desktop wallets, then you should give preference to this application. The client can be downloaded for almost any operating system, private keys are stored by the user, and everyone can check the reliability of the client's work, thanks to the open source code. The great advantage of the wallet is that there is a software and online option.

- Gatehub- the platform recommended by the developers of RippleLabs allows you to store XRP, send them to other users, and even exchange cryptocurrencies among themselves. Overall, the wallet is very user-friendly and perfect for beginners.

- Ledger nano s- the most reliable storage option. The developers of the well-known hardware wallet recently added support for the Ripple cryptocurrency, and now you can put your coins in this cold storage. Ledger has a lot of advantages and benefits, but there is a significant disadvantage - it is a paid wallet, for the purchase of which you will need to pay about 60 euros, as well as pay for shipping from France itself.

How to start a Ripple wallet?

It is very easy to create your account on the official Gatehub platform, as well as to use it in the future. But it is not recommended to store a large number of ripples in online storage - if you have purchased large amounts of coins and want to keep them for a long time, then the best option is a hardware Ledger or a free RIPPEX.

To create your wallet on Gatehub follow the instructions:

- Go to the official Gatehub website and select the "Sign Up" section.

- Then enter your mail, password (twice) and go through the anti-bot check.

- You will be offered your wallet access key, which must be kept in a safe place, or better in several places at once and on different media.

- The next step is to confirm the mail, and after the first login, you need to go through forced verification in the form of filling in data about yourself. After that, you can fully use the functionality of the wallet.

Again, note that online wallets are best for keeping small amounts of money needed for fast transactions, while all your long-term investments are in software clients. This is because desktops are safe, but not so easy to use, while coins stored on third-party servers can be exploited comfortably, but trusting these very servers with too many funds is not safe.

Cryptocurrency Ripple - forecast for 2018

Summing up all of the above, it is worth noting that Ripple is a very unusual cryptocurrency that has a powerful technical part, and its protocol is being actively implemented in the banking sector. Already today, very large investors, such as Google, are paying attention to it, which clearly speaks of good prospects. It is also very important that the coin was not conceived as a speculative instrument, as is the case with most dummy cryptocurrencies, and its development is not going in this direction. At the same time, it cannot be denied that the decentralization of Ripple is lame on both legs and the community cannot do anything about it until the developers themselves decide to take appropriate measures.

Not only in 2018, but also in the future, we should expect an increase in the ripple rate, because the number of coins will decrease, and demand will grow. Therefore, now, when the cryptocurrency rate is quite low, it is worth buying at least a small amount of XRP, which in the future may dashingly rise in their price. Well, we will not look into the distant future - will Ripple justify forecasts and surpass Bitcoin or become the property of exclusively the banking sector - in any case, the coin and the protocol will still have time to loudly declare themselves.

September 16, 20178 reviews for "Ripple Cryptocurrency - Banking Innovation and Investment Ripple"

Ripple coin perchage Karna hai

2020 tak kya rhegi

Sem compromisso, quanto você acha e a moeda atingirá daqui a 1 ano?

kalau beli Riak aman gak ya?

buy ripple

Czy posiadajác teraz 1000 - 1 tysiac sztuk tej monety za 1000PLN +/- myslicie ze ta kwota zrobi kiedys przynajmiej 1 milion zlotych polskich?

Bagus sekali untuk menambah pengetahuan tentang ripple

In the world of cryptocurrencies, there are systems that attract increased interest from consumers interested in low-cost transfers, as well as investors who hope to make money by investing in digital coins. Today we will talk about the Ripple crypto-coins. We will tell you about the principles of this network, about what are the ways to make money with this digital currency in the Forex market, and we will try to understand the investment prospects for the near future.

In order to profitably invest in crypto coins or play on exchange rate differences within short time intervals, you need to understand what digital cash systems are in general, and what features this or that system has.

The rise in price or reduction in price of coins directly depends on the level of interest of network users, and interest is due to the specific advantages that a particular cryptocurrency system provides. Such advantages can be: the speed of confirmation of transactions, the level of anonymity of transfers, the ability to use the system for some other needs (for example, as a platform for creating cloud services). Therefore, let's start with a description of the Ripple (XRP) system and consider its distinctive features, and then move on to a description of the earning mechanisms.

What is the interest of investors

The raison d'être of all cryptocurrencies is to provide its users with the ability to quickly and inexpensively transfer money around the world. Banks pursue approximately the same goal, but their similar services, firstly, are much more expensive, and, secondly, banks cannot provide the proper level of anonymity and require too much personal information from the client. Due to the complete control of banks by the state financial system, information about private transfers becomes known to a wide range of people. Moreover, the bank account may be suddenly blocked, and the client will not be able to use the funds belonging to him.

The Bitcoin network became the first cryptocurrency system where transfers, firstly, were free, secondly, anonymous (to carry out a transfer, it is enough to know only the wallet number), and, thirdly, they had a high level of security. Since the system is decentralized (management is carried out in a fully automatic mode), the mechanisms of the crypto network ensured the impossibility of blocking wallets. After it became clear that digital currencies are becoming more popular than the traditional bank transfer system. Developers began to be created wanted to repeat the success of Bitcoin and make good money on it. Accordingly, the likelihood of a rapid rise in the exchange rate began to attract investors.

Distinctive advantages

Many digital coins were developed using the same technology as BTC (Bitcoin exchange ticker) - Blockchain (blockchain), it was not so difficult to create a new coin, since this technology has an open source code. However, some coins, although they were based on the same principles (anonymity, speed, low transfer cost), are based on different algorithms. One of these is Ripple (XRP stock ticker). The project started in 2012, shortly after BTC was opened to the world. To date, the cost of one coin has grown hundreds of times, from $ 0.0002 to $ 0.1631, the currency is traded on many cryptocurrency platforms.

Platform

Ripple, like Bitcoin and many of its analogues, is a kind of ledger in which all movements of each coin are recorded. Here, too, transaction confirmations are required to make a record and change the owner of funds, these processes are carried out automatically and are carried out in a very short time. Only the Ripple network has been built and operates not on the Blockchain, but on the payment gateway system, and in principle, such a system can be used not only to transfer units of account within itself, but also to exchange any currencies.

Protection

Users have only 35% of the issued coins in their hands, the rest is under the control of Ripple Labs - this helps to prevent speculative manipulations that could cause a collapse in the value. The mechanism for protecting the network from hacks or failures is implemented as follows: when the load on the network increases (a sharp increase in transactions can be a sign of fraud), the payment for transfers also increases sharply. This forces the attacker to incur significant costs and makes the attack financially unprofitable. When the number of transactions returns to the average level, fees are reduced. In addition, the scheme for the distribution of units of account also performs protective functions.

Mining

A distinctive feature of this currency is also the inability to mine new coins through mining. The deflationary model of the system assumes a one-time emission of all tokens at launch, and over time the number of coins decreases, unlike other cryptocurrencies, which increase the number of units of account through mining. It is noteworthy that the commissions charged during the transfer (extremely insignificant amounts) are simply debited and destroyed (no longer circulated in the system). These crypto coins are not intended to reward miners and are not the profit of the developer company. The write-off reduces the number of coins in the network, this process ensures the implementation of the deflationary model.

Interest of banks and government agencies

The difference between Ripple and Bitcoin and many crypto networks is a deviation from the principle of decentralization. The network is operated by Ripple Labs, the developers of which the digital currency was created. Accordingly, transfers within this network are less anonymous. Banks cannot use decentralized cryptosystems in any way, nor can they interact with them, work on an equal footing, but here, in this regard, there is an obvious plus. From here it is clear that the scheme of this cryptosystem, in principle, can be implemented in the banking sector.

The combination of manageability, high speed of payment processing (at low cost), and multi-currency potential - all this also attracts the attention of banking networks to XRP. In the current state (and even in potential), that infrastructure and organizational system does not allow to drastically reduce the cost and speed up transfers; in some cases, the transaction can be confirmed for several days. When it comes to the study of cryptocurrencies by banks (in particular, the head of the Central Bank of the Russian Federation recently confirmed that virtual cash systems need to be carefully studied), Ripple is most often meant.

Today, the phenomenon of digital currencies is being studied by government agencies. Many states have already come to the conclusion that if it is impossible to prohibit the circulation of crypto coins, then it is possible at least to find mechanisms for tracking payments (in order to prevent their use for illegal purposes), as well as impose taxes on payments. Research projects in this area are paid for around the world, and some lead to quite interesting conclusions. We will now present the results of one such study.

Forecast for the further development of cryptocurrency

It may seem that the active popularization of cryptocurrencies can lead to the destruction of the traditional banking system, because why then banks with their expensive transfers, when there are networks where the transfer, in fact, costs nothing (the base cost of a transaction in Ripple is 0.00001 XRP - thousandths cent). In the best case, the development of cryptosystems will lead to a decrease in the participation of the state (from the point of view of control and taxation) in the turnover of funds.

In turn, banks operate under the control of the government, and digital currencies are not easy to control, so inaction on the part of government agencies (around the world) looks more than strange. But you can consider this process and the attitude of statesmen to it from a slightly different angle.

Environment for existence and development

The first step is to pay attention to the fact that such funds simply could not appear if there was no environment where they could develop. That is, without the Internet, there could be no talk of any digital coins. But banks, for example, could do without the Internet (for example, in the Middle Ages), and, theoretically, can do this even now.

The World Wide Web is a medium for the exchange of information, and the development of this medium does not stand still. First, data was transmitted via the Internet, then programs appeared that work in a network with data located in this network.

A new offshoot: the internet of things

Later, technologies appeared that themselves initiate and carry out the exchange of information between objects (equipment, devices) without human participation. For example, a refrigerator can itself analyze the presence of certain products in it, and if any of them runs out, it can send a request to the delivery service. This phenomenon was called the Internet of Things, the direction is actively developing, and more and more manufacturers (in various industries) are equipping their products with appropriate chips.

The next step is the Internet of money

With the advent of digital currencies, in fact, a new direction has emerged - the Internet of money. Initially, funds (paper, coins) themselves represented, so to speak, a data warehouse, each coin carried information about the comparative value of material goods, equivalent to the value of a particular product. The same function is performed by digitalcoins, provided that the Internet exists, there is no need to translate information into the form of any physical objects.

One can come to the following conclusion: subject to the continued existence of the global network, cryptocurrencies (regardless of the type of platform) will inevitably develop. The destruction of the Internet of money is possible only if for some reason the world wide web (as a method of communication, the Internet of things and money) disappears, which is quite difficult to imagine. Only under the conditions described will there be a return to funds that have a material carrier (gold, paper, etc.).

Ripple perspective

Based on this, it can be assumed that over time, digital currencies will soon replace real money, which means that the value of coins will gradually grow. Therefore, in the long term, investing capital in them is a completely logical decision.

Accordingly, at the state level, there will also be a change in the money turnover model, and at the moment, perhaps, in some countries, the most efficient (but at the same time controlled) cryptosystem is being selected. And only when the selection is completed, concrete steps will begin to oust the rest of the chains from the market.

If we talk directly about Ripple, then it should be noted that this is one of the few systems that integrate into the existing banking environment, therefore, the growth in the cost of payment tokens of this system will grow faster than that of competitors.

How to earn

There are several ways to make money on Ripple, which we will now consider:

- Direct investments within the exchange floor. To buy cryptocurrency, you need to register in the Ripple system and create a wallet. Then you need to go through the registration process on a cryptocurrency exchange, today this currency is traded on many platforms, the largest are EXMO, KRAKEN, Poloniex, Livecoin. An account will be created in the exchange account to which you want to transfer money, as well as an XRP wallet.

After that, it remains to place an order to buy at the most favorable price, and when the price reaches the level you specified, the order will be satisfied. The money will be debited from your account and the title units of the system you need will be transferred to the wallet.

Then you can leave coins on the exchange account or withdraw them to the wallet that you registered in the system. For long-term investments, it is necessary to choose a reliable storage method, since cryptocurrency exchanges are periodically attacked by hackers. You can sell Ripple on the exchange when you think that the rate has risen sufficiently and it is time to take profits.

To speculate in the short term, you need to determine the price range in which the coin is trading and buy at the lower border in order to sell when the rate rises.

- Investing in Ripple through a Forex broker. When working through, the same trading technologies are used as during direct investments on the exchange. However, this method has its advantages:

- Due to leverage (from a broker), you can get more profit than on an exchange with the same amount of capital;

- The broker's trading platform has more tools for market analysis.

Is it worth mining Ripple

In conclusion, I would like to give a comparison of Ripple with Bitcoin, this will help to visually assess the prospects. The popularity of BTC at the moment is based on the long-term reputation of a stable and efficient transfer system, while the popularity of XRP is growing due to the prospects for development as a state system.

Therefore, it cannot be ruled out that the growth in the value of the cue ball may slow down somewhat, especially considering that in the past few months this growth has been taking place exclusively on the wave of the excitement associated with the recent sharp rise in price. But interest in Ripple has, so to speak, a real basis, therefore, in terms of the speed of development, it can even overtake Bitcoin.

Nevertheless, when planning investments, it is worth remembering the risks, investing in cryptocurrencies is no less risky format than working with any other Forex tools.

This material was written the most difficult in comparison with reviews of other cryptocurrencies. After all, there are features here and there is something to puzzle over. The creators, using modern IT technologies, offer the world a bold and unusual solution in the financial world. Well, let's figure it out ...

How the Ripple cryptocurrency appeared

In fact, Ripple is more viewed as an internet technology that allows financial transactions. Initially, Ripple Labs did not plan to create its own separate cryptocurrency, but was aimed at the banking sector - to provide banks with a unique form of payment. The new technology makes it possible to carry out internal settlements, international settlements between banks in a faster form (reduced transaction time), more secure and, most importantly, with a minimum transaction cost.

Ripple - international payments between banks

Given the specifics of the work, Ripple was written (created) from scratch, without using blockchain technology. This is how Ripple differs from many other cryptocurrencies, which in most cases are forks of Bitcoin.

Fork (English fork - fork, fork) or branch - separation of a software project, as a result of which two independent of each other appear: main and new. For example, Ethereum and Ethereum Classic.

Banking institutions are eyeing the Ripple Internet Protocol, and some are already testing and working with Ripple. For example, in early 2017, the National Bank of Abu Dhabi (United Arab Emirates) showed interest in Ripple, now joint work is underway with some banks in Japan (Daiwa Next Bank, Mizuho Bank, Nomura Trust, Sumitomo Mitsui Trust and ORIX Bank).

The company presents its expediency of application in the banking sector on the first page and focuses on this. After all, the main advantage is cost savings and increased efficiency. The official website even provides a calculator that shows the savings in financial transactions. The main competitor for the right to work with banks is Swift.

The revolutionary approach to the financial system offered by the Ripple system is based on the following concepts:

- lines of credit;

- credit money;

- mutual trust;

- a netting system (without using money as such).

The basic principle of operation is reminiscent of the essence of Hawala and the use of The Theory of Six Handshakes.

Hawala (Arabic - transfer) is an informal financial and settlement system based on the offset of claims and obligations between brokers, used mainly in the Middle East, Africa and Asia. The system was formed in Hindustan long before the appearance of the Western banking system ... all financial transactions are carried out by the offsetting method.

The six handshake theory is a theory according to which all people on Earth have communication with each other through no more than five levels of mutual acquaintances (and, accordingly, through six handshakes).

The six handshake theory

After studying a lot of materials about the work of the Ripple cryptocurrency, I understood how the system works, but I still have many questions, one of which is: "Why do I need this and where can I apply it?" This is a subjective opinion.

The system will have its users and fans, this will take time and practice in real life. For example, the system works with any currency and, having US dollars, you can settle accounts with the system participants in any other currency or even gold. It is supposed to use barter operations between participants and is well suited as an exchanger.

How interesting will it be? What and where will the benefits of using the system be? Demand and relevance? Here are the main questions that Ripple must answer in the near future to show its effectiveness in practice. And we will be watching the development and application, since one article about Ripple is not enough here.

Ripple benefits

The Ripple cryptocurrency is the internal currency of the Ripple system. It provides ordinary users (as well as banks) with the best qualities that can be in a payment system:

- decentralization (distributed payment system);

- fast transfers (the ripple network works much faster than bitcoin, transaction confirmation, as in bitcoin, is not required);

- no commission;

- full control of your funds.

It has a relatively large volume of issue - 100 billion coins and they are already in circulation. The coin is divided into 1 million pieces. The very name Ripple translates as “Ripple on water”, and part of the coin is called “drop” - a drop.

1 XRP - Ripple coin

As a digital currency, it deserves special attention, as it has a unique approach in its code and this is what makes it different from others. It uses a different algorithm, different concepts and developments, differs in the transaction confirmation system. Therefore, it is illogical to compare Bitcoin with Ripple, each currency goes its own way. And it should be noted that they began to talk about Ripple earlier, back in 2004, long before Bitcoin.

Comparing Bitcoin to Ripple is illogical

But a lack of investment in technology development held back progress, and Ripple took a long time to reach its heights. Only after raising capital and the emergence of a development team did things go more efficiently. By the way, one of the investors was Google. And support from banks gives hope for the future of Ripple.

Features of the currency

The cryptocurrency uses its own protocol - the Ripple Protocol consensus. Those attacks and problems that Bitcoin had at one time will simply not work here ("51% attack" is not applicable). The system hasn't had any major outage issues ... not yet. After all, experts consider the software used to be unreliable in terms of security. So, the China Center "CERT" (National Computer Security Threat Response Network) at the end of last year conducted research and gave Ripple a "bad rating" - the source code is very vulnerable.

Perhaps Ripple is temporarily uninteresting to hackers. Or maybe the scheme works - 0.00001XRP is debited for each transaction made. And this amount of XRP could be increased if the system sees a significant increase in the number of transactions. As a result, the machinations of a hacker at some point will become simply unprofitable (effective protection against DDoS attacks). It should be noted that no one receives 0.00001XRP as a reward, but is simply debited (the number of coins decreases). This is a kind of deflationary process. And with the massive recognition of cryptocurrency, its value will grow.

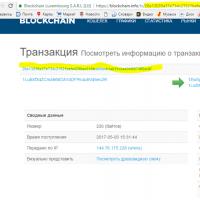

Each wallet has information about all transactions made on the network.

Completed transactions in the system can be reversed. Plus or minus, I don’t even know, without trying it in practice, you don’t know. But this is another unique difference between Ripple and other cryptocurrencies.

The developers of the Ripple cryptocurrency are not considered as a full-fledged means of payment for goods and services. Unlike, for example, Dash, you will not find a list of online stores, gas stations and eateries that will gladly accept crypto for your calculation. And it is unlikely that you will be able, in the future, to pay with this currency for utilities or buy a valuable thing.

How to create a Ripple wallet

To create a Ripple wallet (account), you should follow the link (it is also on the official website of the company):. This page provides detailed instructions for registering an account (in English). There is nothing new, everything is as usual:

- specify mail and enter a complex password;

- you need to save the secret code or upload it to your device;

- we confirm the registration of an account through the link that came to you in your email;

- then you should go through the verification levels (confirm your phone number, scanned copies of your passport).

After passing all the verification levels, you will be taken to your account, where you already have a generated Ripple wallet number. The account has been successfully created, use it to your health.

Ripple said it plans to invest in startups and tech companies that will provide additional use for XRP - its cryptocurrency, currently the third largest by capitalization after Bitcoin and Ethereum. This is reported by Techcrunch.

The total value of XRP is more than $ 128 billion at its peak before the market crash in January. Today, the coin has a total market capitalization of about $ 30 billion. Ripple drew a wave of criticism due to the lack of a declared use of XRP, which was promoted as a tool for banks, but its main client base consists of international money transfer services using XRP as one of the currencies. in their payment streams.

Ripple CEO Brad Garlinghouse told TechCrunch that Ripple is focused on allowing banks to use its software solutions (a suite of services, some of which do not use XRP), but at the same time is also investing in startups that may offer alternative uses for XRP. Garlinghouse said:

We at Ripple are focused on institutional use, but will certainly partner with companies looking to apply XRP in a wide variety of ways.

Garlinghouse noted that Omni, a San Francisco-based startup that offers storage and rental services, is part of that strategy. Ripple and two of its leaders became Omni's top investors, investing $ 25 million in January, and the startup agreed to implement XRP as part of its service.

And Ripple isn't the only company preparing to use volatile tokens to promote their business or ecosystem. At least half a dozen companies that have raised capital through ICOs are planning to invest in startups capable of leveraging their product or platform. Last month, several prominent blockchain companies teamed up to open up a $ 100 million that could expand.

However, in the case of Ripple, it is important that the use of XRP for micropayments is too different from the declared function of a cryptocurrency targeted at banks and financial institutions.

Garlinghouse said concerns about XRP's excessive volatility for payment services are "fake." He noted that the rate will not affect transactions that take a few seconds. Therefore, the question of why banks are not implementing XRP remains open. Garlinghouse believes it will take time, but there will be changes. He recently talked about how Ripple plans to leverage its huge XRP reserves, which he describes as a "strategic weapon." According to him, only the sale of a portion of XRP allows the company to have a positive investment balance.

The big question with XRP's alternative uses is whether Ripple can find the right partners to add value to its product.

Ripple Cryptocurrency: A Complete Investor's Guide Does Ripple Mining Exist

Ripple Cryptocurrency: A Complete Investor's Guide Does Ripple Mining Exist So do banks really need blockchain?

So do banks really need blockchain? Token what is it in simple words What does token mean

Token what is it in simple words What does token mean Remote access to a computer

Remote access to a computer Bitcoin transaction confirmation time: how long to wait?

Bitcoin transaction confirmation time: how long to wait? Versions of the reasons for the collapse of the cryptocurrency market

Versions of the reasons for the collapse of the cryptocurrency market Paid surveys, surveys for money

Paid surveys, surveys for money