How to withdraw bitcoins from coinbase. Withdrawing funds from the Coinbase Bitcoin wallet: a step-by-step guide. Pros and cons of a Bitcoin wallet on Coinbase

Coinbase's bitcoin wallet is cryptocurrency. Every month it is gaining more and more popularity in the world. In this article, we will learn more about the Coinbase wallet and find out how to withdraw money using it. Let's get acquainted with the reviews of the users of the system.

Coinbase wallet

It was opened relatively recently - in 2012. Today, Coinbase is one of the main competitors of another famous wallet. It is called Blockchain. Coinbase is headquartered in San Francisco, California, USA. Today, both of these wallets can boast about the same number of users.

The official Coinbase website has been assigned a domain name, and in addition, several language interfaces. But, unfortunately, there is no Russian among them. This fact immediately catches the eye of compatriots. Many conclude that Coinbase does not work in Russia. This is not entirely true. It is quite possible to use the services of a wallet through intermediaries. Therefore, Russians are actively registering on the site, and as the main one they choose the most easy-to-understand language - English.

Coinbase is quite user-friendly at this point. But, according to most users, it is not perfect. First of all, because it sorely lacks a variety of cryptocurrencies.

At the beginning of this fall, the total number of users of the Coinbase exchange reached a record high and exceeded ten million people. Recently, the wallet has begun to grow significantly. On average, it grows by one million users every month. And this, according to experts, is not the limit. There are over thirty million cryptocurrency wallets registered on this platform.

More recently, Coinbase introduced a new user service that brings customer support over the phone. Thanks to her, through the phone, the company's employees help users with verification issues, blocking access to personal accounts if there are suspicions that they have been hacked, and advice is provided on increasing the limits. There is a ticket system for solving other problems.

The great interest and popularity of the service is also confirmed by the attention of cybercriminals who regularly attack Coinbase by stealing funds from its clients through Trojans.

Sign up with Coinbase

To become part of the system, you need to go to the official website of the American company. On the first page of the portal, you should find the Sign UP button, which is located in the upper right corner. After clicking it, you are automatically redirected to the data entry page. In the window that appears, you need to enter your name and surname. An e-mail address is also indicated and a password is entered. Check the box next to the I agree and then click on the big blue button called Create Account.

Immediately after completing this procedure, the new user is sent an email containing a link. You need to go to it to complete the registration of the Coinbase wallet. This email verifies your email address. It should be noted that the message should be searched not only in the "Inbox" folder, but also in the "Spam" tab, since the system may regard the mailing list from the company as intrusive advertising.

Coinbase account: its own territory

Registration is complete. What then? The client enters their personal Coinbase wallet account. It should be noted that the resource determines the location of the person. On the main page, it provides a report on prices and changes in the exchange rate of Coinbase's main cryptocurrency - Bitcoin. There you can also see information about your national currency. If desired, it is possible to study the change in the exchange rate and other currencies that the wallet of this system supports.

How do I use Coinbase? In the Settings section, you can configure, change, add or make any necessary settings. There is also the option to add an avatar directly to your account, and in addition, enable two-step authentication.

In the Accounts tab, the site user can view the balance of his accounts. Three types of cryptocurrencies are stored inside the wallet of each registered person: BTC, LTC and ETH. To see your address, you need to click on the Receive tab.

affiliate program

The functional set of cryptocurrency wallets is actually the same and does not have any differences. But the one offered by Coinbase has its own distinct twist. It lies in the fact that this system has an affiliate program. A person can access it if they follow the following path on the site: in the upper right corner, click on your name, after which a menu will appear, in which you need to click on the green button with the inscription Get $ 10. Then it will only be necessary to go to the page on which the referral link will be posted. In the event that a user shares it on his pages on social networks or on any other resources, he can get ten dollars.

Coinbase: how to withdraw money?

The wallet of this system provides its users with the opportunity to carry out operations exclusively in cryptocurrency. There are no other ways to work with it. Therefore, in the event that a person wants to replenish the Coinbase wallet with bitcoins from a card, then he will have to use the exchanger. Bestchange is currently considered the best of its kind. Withdrawing funds from Coinbase wallets, in the event that it is necessary to transfer money to the card, is also possible only through exchangers.

Withdraw bitcoins

So, you have accumulated a certain amount. How can you withdraw Bitcoins to your bank card? This is not as difficult as it seems. The choice of the method of output or conversion largely depends on the goals of a particular person. If we are talking about online stores or some kind of service that offers goods and services and accepts payment in bitcoins, then the Coinbase wallet is perfect. In addition, it is important to take a withdrawal option that will allow you to exchange bitcoins immediately for rubles, and also make it possible to conduct an operation at the most favorable Coinbase rate. At the same time, the speed of the procedure is a less important factor in comparison with the financial advantages.

In this situation, the best option is to sell bitcoins through a special exchange, where they are sold and bought for rubles. The algorithm of actions will be approximately as follows:

- The owner of the wallet transfers a certain amount of bitcoins to his account, which was opened within the exchange platform.

- He sells cryptocurrency for rubles. As part of this procedure, funds are transferred to the client's respective account on the exchange.

- The client makes a withdrawal of rubles to his card.

The procedure is complete! It is noteworthy that the withdrawal process through the exchange provides an opportunity to sell bitcoins at the most favorable rate. At the same time, the Coinbase commission will be minimal, however, the exchange operation will take some time.

In the event that it is required to transfer a relatively small amount of cryptocurrency to the card in a short time, for example, to perform urgent settlements, then the withdrawal of bitcoins can be made through an exchange service. This procedure will take very little time. In this case, the waiting period will directly depend on how quickly the banking institution servicing the card will credit the money. The operation takes place in automatic mode. As a rule, the order of actions is as follows:

- The owner of the bitcoins transfers them to the wallet, which is indicated on the exchanger's resource.

- The servicing service transfers rubles from the card account to the plastic of the counterparty, which is indicated in the exchange request.

Usually exchangers have accounts in different banks, thanks to which the money transfer, as a rule, does not take much time. Application for the withdrawal of exchange services involves the payment of a commission. But we can say that this is completely offset by speed and convenience.

Bitcoin withdrawal and electronic payment systems

In the event that an Internet user earned a certain amount of bitcoins through his project, but does not need cash, he can exchange them for the title units of payment systems. So, how to withdraw bitcoins from your wallet to electronic accounts?

Based on the reviews on Coinbase, the answer to this question is pretty straightforward. Withdrawing bitcoins can be done through an exchange service. This procedure was described above. In addition, bitcoins can be directly transferred to an electronic system - provided that it supports them. For example, such an assistant is the well-known WebMoney wallet. Among other things, a direct exchange is also permissible, which excludes intermediary services. For these purposes, the owner of bitcoins can sell them to absolutely any user who offers to pay with a certain currency or title units. True, it should be noted that this method is considered quite risky, since the seller may simply not wait for the return payment.

Thus, summarizing all the advantages and disadvantages of the listed Bitcoin withdrawal methods, we can conclude the following:

- The exchange offers the most favorable exchange rate. But in this case, it should be borne in mind that this process can take a lot of time.

- Exchangers quickly convert coinbase Bitcoin into rubles and transfer them to the card, but the exchange rate itself is less profitable and attractive.

- Direct exchange makes it possible to avoid paying a commission, to determine the ratio of currencies yourself, however, it is fraught with risks.

What is provided?

Previously, national currencies could be provided with silver or gold, now - GDP. In theory, you could go to any bank in the country and exchange your paper money for the equivalent in gold and vice versa. Bitcoin is not backed by anything - it is pure mathematics.

Anyone anywhere in the world can run a script for mining bitcoins on their computer, and they can feel like a miniature central bank. The source code of the script is published in open form, everyone will see how it works.

Bitcoin withdrawal: security measures

Working with electronic money requires a certain amount of caution. As when withdrawing bitcoins from your wallet for the purpose of their subsequent conversion into money or title units, security measures must be observed when buying cryptocurrency. Before using the services of exchange services or an exchange for the first time, it is recommended to make inquiries and make sure that the service actually carries out exchange operations, and is not designed solely for fraudulent purposes. Studying the feedback on the work of these resources can help you make a final decision. And in the event that the overwhelming majority of comments are negative, then this can be regarded as a sufficient reason not to withdraw Bitcoins through this service.

Now let's find out what the people who use it have to say about Coinbase.

Reviews: negative experience

It should be noted right away that there is no single point of view about him. There are conflicting opinions in reviews about Coinbase, and there is a lot of dissatisfaction with this wallet on the Internet. People say that this company stores personal keys from users' wallets on their unsecured servers. Therefore, clients believe that it is, in principle, no different from standard banks. Among the most common criticisms, the following were noted:

- Coinbase monitors how people spend the bitcoins they buy through its official website.

- This system often freezes payments.

- It's not uncommon for Coinbase to block user accounts.

- The system steals funds from the accounts of its clients, making a refund after an indefinite period.

- Coinbase can ignore customer support calls for months.

- The system provides personal data and transactions to foreign authorities, in particular in the interests of the FBI.

Users, in particular, say that the Coinbase support service does not respond to requests for a long time, so many got the hang of such cases of ignoring their requests to upload the problem to the social site Reddit, where they are at least noticed and help to solve this or that issue related with a wallet.

In addition, judging by some reviews about Coinbase, the company reserves the right to confiscate amounts of several thousand dollars from users and close accounts due to the fact that people entered this service from a different IP address. But, perhaps, the most important drawback people consider the lack of anonymity in the framework of the use of this system. For this reason, users write that they simply do not trust the Coinbase wallet.

In addition, it often happens that this system lowers the limits for people on certain purchases. There are also complaints that when selling bitcoins for a certain amount, 50 percent of the profit may not be sent. In such situations, it remains only to write in support. Some also talk about receiving threats from Coinbase about account freezing due to sending cryptocurrency to the site.

Among other things, users complain that the purchase function, as well as the withdrawal of currencies, is not possible on the territory of the CIS countries. Indeed, Coinbase does not directly operate in Russia. There are also dissatisfaction with the high commission.

Feedback: a positive experience

On the positive side of this system, people report that they like the mobile app for keeping track of their accounts. Another plus is called the free ability to transfer funds from one balance to another directly within the profile itself.

Coinbase has also received positive reviews for its low outbound transaction fees, along with its responsiveness and availability. Despite the dissatisfaction, the wallet of this system is very popular today, as it interacts with many payment structures that work with mobile phones.

There are many positive aspects. However, in general, people resent that Coinbase could delay payments for four to ten days, freeze user accounts and stretch support response times by tracking down their customers' online behavior.

Hello friends, today we decided to dedicate an article to the Coinbase cryptocurrency wallet. In this article, you will learn how to register a Coinbase wallet and its main functions, we will not delay for a long time with an introductory word and let's get started.

Coinbase wallet is one of the main competitors of the native bitcoin wallet -. Coinbase is headquartered in San Francisco, California. At the moment, these two wallets have roughly equal numbers of fans. Coinbase's official website has the domain name www.coinbase.com, and multiple language interfaces. But there is no Russian among them, so we choose the easiest English language for the Russian-speaking population to understand. Let's go through the registration.

Coinbase wallet. registration

To register for coinbase, you need to go to the official website, it looks like this.

On the main page of the Coinbase website, find the inscription "Sign UP", it is located in the upper right corner. In the picture, we pointed to it with a red arrow. After that, you are taken to the data entry page. You must enter your first and last name, enter your email address and come up with a password. Check the box next to “I agree… ..” and click on the big blue “Create Account” button.

After that, you will receive a letter in your mail, in which you will need to find a link and follow it. This is the email that verifies your email address. By the way, after sending the letter, check not only the "Inbox" folder but also the "Spam" folder, because it came to us exactly there.

After confirmation, you will be taken to your Coinbase wallet account. It is worth noting that Coinbase determines your location and on the main page gives you a report on the cost and change in the exchange rate of the world's main cryptocurrency, in your national currency. Optionally, you can view changes in rates and other currencies supported by the Coinbase wallet - and.

In the Settings section of your Coibase wallet, you can customize, change, add, and make any settings you like. It is possible to put an avatar of your account and enable two-step authentication.

In the "Accounts" section of the coinbase exchange, you can see the balance of your accounts. Since we use a demo account for the review, we have zeros in our section. In order to see the address of your cryptocurrency wallet, we recall that inside your wallet you have 3 types of cryptocurrencies BTC, ETH and LTC. You need to click on the "Receive" button and you will be shown your address.

Coinbase wallet. Coinbase Wallet Affiliate Program

Coinbase is a type of cryptocurrency exchange. A significant advantage of this service is the "cold" storage of funds, 98% of them are stored on servers that are not connected to the network, which ensures a high level of security. The rest of the crypt on Coinbase is covered by insurance. Also for security purposes, a two-tier authentication structure was added, the confirmation of which is carried out using a mobile phone.

As for operations with the currency itself, on the coinbase wallet, very low commissions (2.5%), and when performing an operation between two Coinbese users, it is completely absent. In the software system, the exchange of cryptocurrency for fiat is done instantly, but this option is available only if you are a US citizen.

In fact, all the disadvantages of the Coinbase wallet in question are related to the rules for using the system itself. So, as all a number of advantages (high-speed transactions, scanty commissions, lightning-fast cryptocurrency exchange), can only be used by residents of the United States. This creates a mixed opinion about this service. And somewhat discriminates against all other users who do not have American citizenship.

The cost of bitcoin in 2017 reached its maximum value for the entire existence of the cryptocurrency. As of December 9, 2017, the rate is $ 15,000 for 1 BTC. The question becomes relevant - where and how can withdraw Bitcoins from the wallet to a card, exchange it for cash rubles, dollars, payment systems Qiwi, Yandex.Money, Advcash and others as profitably as possible and with minimal commissions.

Often there are questions about withdrawing Bitcoin to real cash or to a Visa / Mastercard bank card. Banks in Russia, Belarus, Ukraine and other CIS countries do not officially work with cryptocurrencies yet. Therefore, in the article we will consider the main ways how to withdraw Bitcoins to the card from the exchange account, from the Blockchain online service to payment systems and then withdraw cash from an ATM.

You can withdraw Bitcoin in 2019 using the following methods:

Bitcoin is a cryptocurrency called "digital gold". Recently, you can pay them for purchases and services, since many online stores began to accept it for payment. Market capitalization exceeded USD 263 billion.

It is very easy to withdraw Bitcoins from your wallet and transfer them to another address. As a rule, you need to click "Send", "Withdraw" or "Send"; specify the address of the Bitcoin wallet, the amount of BTC transferred and the commission (on exchanges it is fixed).

- Withdrawing Bitcoin from the Exmo wallet. You need to go to the section "Wallet" - "BTC" - "Withdraw". Indicate the amount. Commission - 0.0005 BTC or about $ 4 at today's rate. The minimum amount is 0.01 BTC; the maximum is 350 BTC.

- Conclusion p.

You must click "Send", enter the recipient's address and indicate the amount.

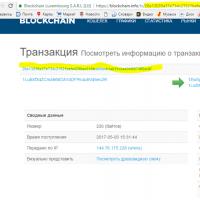

Pay attention to the commission, it is needed for the fastest processing of the transaction. By default, its optimal size is set, but you can specify a higher commission, then the operation will be faster. Confirmation usually occurs within an hour.

- In a crypto wallet, which is designed to store popular cryptocurrencies Bitcoin, Ethereum, Zec, Ripple, Dash and others: to withdraw Bitcoins, select "Send", insert the recipient's address and the amount:

Withdraw bitcoins through the exchanger

The easiest and fastest way is to withdraw through, by converting one currency into another.

Through exchange offices it becomes possible withdraw Bitcoin to Sberbank card, Privat24, Alfa Bank, Tinkoff, Avangard, Russian Standard, VTB 24, to any Visa or Mastercard.

The algorithm of actions is as follows:

- Transferring bitcoins from your wallet to the address of the exchange office;

- The exchanger transfers rubles or another from his account to the details you specified when performing the operation.

- Prostocash.

- 60cek.

- Ramon Cash

- Baksman.

- Xchange.

Let's show it using the example of the Prostocash exchanger, since it has positive reviews on the Internet, has solid reserves and a large number of payment systems. The exchange takes place in manual mode within 5-15 minutes.

After going to the prostocash.com website, it is recommended to register and receive a 0.05% bonus for this when making a transaction.

We carefully fill in the data: number, bank name, full name. owner:

Reviews on the Internet are positive, customers are satisfied.

Reviews on the Internet are positive, customers are satisfied.

In exchangers, you can not only exchange, but also electronic systems, etc.

How to withdraw Bitcoin through the exchange

You can withdraw Bitcoins through exchanges, where the process of buying or selling cryptocurrency between platform users takes place.

The main advantages are working with rubles and hryvnias, favorable rates, a large selection of ways to deposit and withdraw money. Basically, exchanges do not take commissions for operations, but they can be set by payment systems.

Algorithm of actions, how to withdraw Bitcoin (BTC) through the exchange:

- We register.

- We transfer bitcoins to the exchange account from our wallet.

- We perform trade operations or exchange for a ruble account RUB (an account in UAH hryvnias, USD dollars or another).

- We withdraw money using available methods: to Visa and Mastercard, Yandex.Money wallet, Qiwi, etc.

Carefully read the minimum, maximum limits and withdrawal regulations, as this process can take several days.

Let's look at the example of the exmo.me exchange. Its advantage is that there is a large selection of withdrawals to payment systems, including cards of Russian and Ukrainian banks.

When registering on the exmo.me website, enter your username, e-mail, password, read the terms of the agreement:

Log in to the Eksmo website using your username and password. Go to the "Wallet" section and in front of the BTC currency click "Replenish".

Copy the address for replenishment (minimum amount - 0.001 BTC):

Read the translation instructions and copy the address. You need to transfer the exact amount and in a strictly limited time (within 15 minutes).

Go to your wallet and withdraw Bitcoins to the specified address. After crediting money, proceed to their withdrawal.

Go to the "Transfer of funds" item, there are available ways:

- Transfer between wallets in the system itself.

- To the Advcash card.

- To a bank card.

- Into electronic currency (Perfect Money, Payeer, etc.).

- Cash (Russia, Ukraine).

- Through exchangers.

Using cryptocurrency begins with creating a wallet to store it. For this, there are software offline and web wallets, as well as special devices for accessing a cryptocurrency account. They differ in the way passwords are stored and in functionality. Wallet security and the ability to resist hacker attacks play an important role. Coinbase wallet embodies these qualities, demonstrating convenience, reliability and efficiency.

Coinbase wallet features

Coinbase was launched in 2012 and has attracted over a million users in its first two years. The wallet is only a small part of the range of services provided by the service. The company receives its main income from the activities of a cryptocurrency exchange, available to users in 32 countries. Those wishing to start trading should know that the Coinbase marketplace does not work in Russia. Accordingly, the site lacks support for the Russian language. This limitation does not apply to, which can be used by everyone.

How to create a Bitcoin wallet on Coinbase

The crypto wallet is available only to registered users. Despite the absence of a Russian interface, the procedure is not difficult even for beginners. To create a Coinbase account, follow these steps:

You will have access to your Coinbase account settings and registration is complete.

For the convenience of work, you should choose the US dollar - the most common and liquid currency. In this case, the rate of bitcoin, bitcoin cash, litecoin and ether on the main page will also be displayed in dollars.

Safety

To increase access security, enable two-step verification in the Setting section of your personal account. It serves to protect against unauthorized entry to the site and to confirm transactions on the exchange.

To do this, there is a mobile application that scans the QR code when you log into your account and make payments. In case something happens to the smartphone, there is a secret sixteen-digit code. It must be saved and entered after installing the authentication program on another device.

Verification

This procedure is needed for those who need more than just a cryptocurrency wallet. After confirming your identity, you will be able to trade on the exchange and withdraw the earned funds. For verification, you need to enter the address of residence, place of work and passport data. The list of other data that is required to verify identity depends on the country of residence. Americans need to enter the last four digits of their SSN.

The exchange is even interested in the origin of the coins. You will have to indicate one of three options: investment, stock trading or mining. However, this procedure, like trading on the site, is available to residents of a limited number of countries.

How to view the balance and replenish the account

Open the Accounts section. Your BTC, ETH and LTC wallets and balance are displayed here. Below them there are buttons for replenishment and withdrawal - Receive and Send. To be able to pay with coins, you need to top up your account.

To do this, you need to click the Receive button under the balance of the currency of interest. A window will open with the address of the wallet and a QR code, which are needed to transfer funds within the system or through an exchange site. The code is scanned by the mobile app, and the address is used to send money from offline and web wallets, exchanges and exchangers.

The latter allow you to replenish the wallet from a bank card or using other digital currencies that are not supported by the wallet.

Residents of the USA and Europe can deposit funds to Coinbase directly from bank cards. To do this, you need to link your bank card to your exchange account. This is done in the Payment Methods section of your personal account. It will be possible to withdraw funds to the linked cards later. You can also do this through PayPal, which is also attached to your account.

How to withdraw money from Coinbase

After the creation of the wallet, the transfer from Coinbase is not available. Transactions can be made only after the funds appear on the account. The system provides several translation options:

- Coinbase internal transfer. Transfer between wallets of the system to the email address specified during user registration. To do this, you do not need to specify the external address of the crypto wallet.

- Transfer within Bitcoin, Litecoin and Ethereum systems. To do this, you must specify the exact address of the recipient's wallet.

- Exchange for fiat money. Residents of the USA, Canada, Australia, EU and Singapore can withdraw bitcoins from their account directly to bank cards or through PayPal. In this case, crypto coins will be automatically exchanged for the target currency in accordance with the current exchange rate.

The commission for withdrawal and exchange differs depending on the type of wallet, country of residence and currency.

Restrictions

Fast and instant buying and selling digital currencies is only available for the United States and a few other countries. Proxy servers cannot bypass these rules. It is not the IP addresses of users that are checked, but personal documents and bank card numbers. You can find out about other limits on Coinbase in the corresponding section of the site.

Coinbase Benefits

- Two-factor security keeps your e-wallet safe. Confirmation via SMS or QR code will not allow attackers to steal funds even if the password is stolen.

- The speed of transactions within the service is higher, and the commission is not charged or lower.

- Coinbase wallet has all the features of a standard cryptocurrency wallet and complements them with exchange for fiat.

- The presence of mobile applications for iOS and Android allows you to control your account and manage money without being tied to an office or computer.

- Funds in accounts are insured in case of system hacking and other unforeseen situations.

- To protect against hacker attacks, Coinbase keeps no more than 2% of users' funds online. The rest of the coins are in offline storage.

- The presence of a referral program makes it possible to earn by attracting new users.

- The site does not conflict with the laws of the countries with which the work is supported.

Disadvantages of Coinbase

- The system does not work with countries whose legislation is considered unacceptable.

- The development strategy is focused on developed countries with large investors. As a result, the exchange is inaccessible to Russia and many other countries.

- There is no Russian wallet interface.

- For verification, you have to indicate personal data, which violates the principle of anonymity, which is the basis of cryptocurrencies.

The Coinbase wallet can be recommended to domestic users as a backup storage of coins. For unverified users, the wallet does not have additional attractiveness due to the lack of the possibility of conversion and work with the exchange.

Want to keep abreast of the latest news and get free insights? Subscribe to our,

Cryptocurrency bitcoin wallet Coinbase is becoming more and more popular not only in Russia, but also abroad. In this article, you can learn more about not only the functions of this wallet, but also how to withdraw money from Coinbase.

Can I withdraw money from Coinbase

Virtual wallets in this system give their users the ability to carry out various operations using only cryptocurrency. There are no other methods of working with this service.

Therefore, in a situation where a person wants to put bitcoins into his account with Coinbase, he should use a special exchange office, among which Bestchange is considered one of the best. You can withdraw funds from such a wallet, either by transferring them to a card, for example, of Sberbank, or also through exchangers.

General information on withdrawing funds

If you have accumulated a certain amount of money on your Coinbase wallet, and you are thinking about how to withdraw it from your account and get cash, it is recommended that you pay attention to several ways. In general, this is not as difficult as it might seem.

The choice of a withdrawal or conversion method is based on the goals of a particular user. If you mean an online store or other service that sells something that you can pay for with cryptocurrency, then the Coinbase wallet is best suited for such purposes. In addition, it is better to dwell on this option, using which at the exit, you can immediately get rubles at the most favorable rate. The speed of this process is not so important a factor.

A good option for implementing a cryptocurrency is special exchanges where bitcoins are purchased and sold in rubles. In this case, you need to act like this:

- the account owner transfers a certain amount of bitcoins to the account opened on the exchange floor;

- cryptocurrency is sold for rubles, after which the money is credited to the client's account on the selected site;

- rubles are displayed on the card.

The operation of withdrawing bitcoins on the exchange makes it possible to sell them at the most favorable rate for the user. The fees on Coinbase itself will be small, but the exchange will take some time.

If you need to transfer a small amount to the card as quickly as possible, for example, if you need to urgently pay someone, bitcoins can be withdrawn through the exchanger. This is a very fast process. The waiting time is influenced by the speed of the bank, which will credit the finances to the card. The procedure is carried out automatically. You should act like this:

- the owner of the cryptocurrency transfers it to the account indicated on the website of the exchange office;

- through the service, rubles go from the card to the card of the counterparty specified in the exchange request.

As a rule, exchangers have accounts with various financial institutions, which is why money is transferred quickly enough. Using an exchanger involves paying a commission, but this is more than compensated for by speed and convenience.

Coinbase and virtual payment systems

In a situation where a user, having implemented his project on the Internet, earned a certain amount of bitcoins, he can exchange them for title units of the service for making payments.

If you believe the feedback left in the Coinbase system itself, this method of withdrawing funds is quite easy. The cryptocurrency is sent directly to the electronic system in which it is supported.

Services WebMoney, Yandex can come to the rescue. Money or direct exchange without intermediaries. In this case, the owner of the cryptocurrency can sell it to any user who offers to make a settlement either in bitcoins or in title units. This method is associated with a high risk, because. the naive seller may simply not wait for the payment to arrive.

Step-by-step instructions for withdrawing money

A wallet in the Coinbase system allows you to store, transfer and withdraw cryptocurrency, and in order to do the latter, you need to take several steps:

Restrictions and limits

The main limitation in the system is that only those who are within the United States can instantly purchase cryptocurrency here. Another feature available only to Americans is the instant fiat-to-cryptocurrency exchange.

Important! Bypassing the described restrictions using VPN will not work, because. in addition to registering with the service, in order to work with bitcoins, you must go through a check of all the documentation of a private person. The developers provided for the fact that many people will try to circumvent the rules.

Possible problems and solutions

When manipulating electronic money, one should not forget about caution. When carrying out the withdrawal of a certain amount of money from Coinbase in order to then convert them into currency or title units, or when purchasing cryptocurrency, you need to follow some rules.

Before using the exchanger for the first time, you need to learn more about it, and also make sure that exchange operations are actually carried out in this system, and not created by fraudsters for the purpose of profit. It is better to make the final decision based on feedback on the work of existing resources. If the comments are mostly negative, this could be a good reason not to withdraw cryptocurrency through this system.

Pros and cons of the system

Coinbase has the following strengths:

- two-factor safety;

- storage of currency in the system;

- carrying out any transactions with currency;

- transaction confirmation speed;

- currency insurance, etc.

But, in addition to this, users also have complaints related to insufficient technical support of the service. In addition, the fact that Coinbase stores individual keys of its customers on its own resources, which makes them vulnerable, also causes discontent.

Although the Coinbase system today is not able to serve all the world's states, it is rapidly gaining credibility and attracting more and more new users.

Ripple Cryptocurrency: A Complete Investor's Guide Does Ripple Mining Exist

Ripple Cryptocurrency: A Complete Investor's Guide Does Ripple Mining Exist So do banks really need blockchain?

So do banks really need blockchain? Token what is it in simple words What does token mean

Token what is it in simple words What does token mean Remote access to a computer

Remote access to a computer Bitcoin transaction confirmation time: how long to wait?

Bitcoin transaction confirmation time: how long to wait? Versions of the reasons for the collapse of the cryptocurrency market

Versions of the reasons for the collapse of the cryptocurrency market Paid surveys, surveys for money

Paid surveys, surveys for money